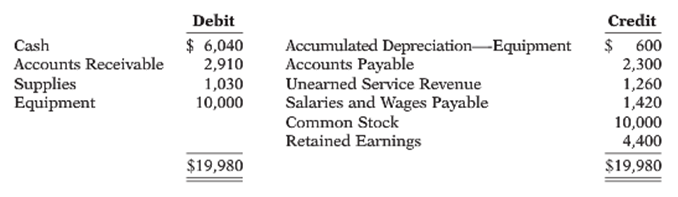

On August 1, 2014, the following were the account balances of D&D Repair Services. During August, the

Question:

On August 1, 2014, the following were the account balances of D&D Repair Services.

During August, the following summary transactions were completed.

Aug. 5 Received $1,200 cash from customers in payment of account.

10 Paid $3,120 for salaries due employees, of which $1,700 is for August and $1,420 is for July salaries payable.

12 Received $2,800 cash for services performed in August.

15 Purchased store equipment on account $2,000.

17 Purchased supplies on account $860.

20 Paid creditors $2,000 of accounts payable due.

22 Paid August rent $380.

25Paid salaries $2,900.

27 Performed services worth $3,130 on account and billed customers.

29 Received $780 from customers for services to be provided in the future.

Adjustment data:

1. Supplies on hand are valued at $960.

2. Accrued salaries payable are $1,540.

3. Depreciation for the month is $320.

4. Services were performed to satisfy $800 of unearned service revenue.

Instructions

(a) Enter the August 1 balances in the ledger accounts. (Use T-accounts.)

(b)Journalize the August transactions.

(c) Post to the ledger accounts. Use Service Revenue, Depreciation Expense, Supplies Expense, Salaries and Wages Expense, and Rent Expense.

(d) Prepare a trial balance at August 31.

(e) Journalize and post adjusting entries.

(f) Prepare an adjusted trial balance.

(g) Prepare an income statement and a retained earnings statement for August and a classified balance sheet at August 31.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Accounting Tools for Business Decision Making

ISBN: 978-1118128169

5th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso