On August 31, 2017, Pacquet Inc. (Pacquet) purchased 100 percent of the common shares of Schwitzer Ltd.

Question:

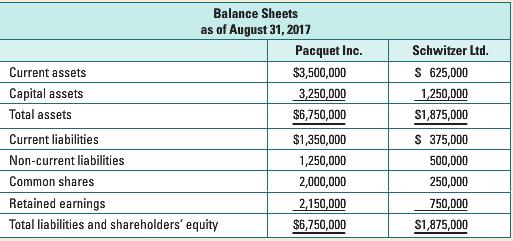

On August 31, 2017, Pacquet Inc. (Pacquet) purchased 100 percent of the common shares of Schwitzer Ltd. (Schwitzer) for $2,000,000 cash. Pacquet's and Schwitzer's balance sheets on August 31, 2017 just before the purchase are as shown in the following table.

Management determined that the fair values of Schwitzer’s assets and liabilities were as follows:

Fair value of Schwitzer’s identifiable assets and liabilities on August 31, 2017

Current assets.......................$ 875,000

Capital assets.........................1,950,000

Current liabilities......................375,000

Non-current liabilities..............550,000

Required:

a. Prepare Pacquet’s balance sheet immediately following the purchase.

b. Calculate the amount of goodwill that would be reported on Pacquet’s consolidated balance sheet on August 31, 2017.

c. Prepare Pacquet’s consolidated balance sheet on August 31, 2017.

d. Calculate the current ratios and debt-to-equity ratios for Pacquet, Schwitzer, and for the consolidated balance sheet on August 31, 2017. Interpret the differences between the ratios. When calculating the ratios, use Pacquet and Schwitzer’s balance sheets after the purchase had been made and recorded.

e. You are a lender who has been asked to make a sizeable loan to Schwitzer. Which balance sheets would you be interested in viewing? Explain. How would you use Pacquet’s consolidated financial statements in making your lending decision?

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: