On February 23, 2005, eBay acquired Viva Group, Inc., which does business under the name Rent.com, for

Question:

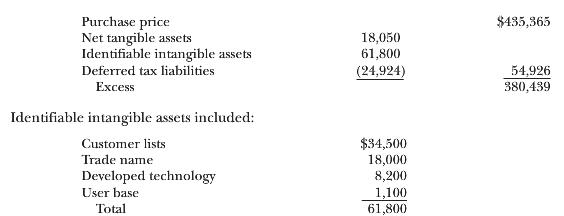

On February 23, 2005, eBay acquired Viva Group, Inc., which does business under the name Rent.com, for a cash purchase price of approximately $435.365 million including net cash and investments of approximately $18 million. Rent.com is an Internet listing website in the apartment and rental housing industry. The motivation for the acquisition was to help expand eBay’s presence into the online real estate market. Also, $2 million in estimated acquisition-related expenses were incurred. The acquisition was treated as a nontaxable purchase transaction and, accordingly, the purchase price has been allocated to the tangible and intangible assets acquired and liabilities assumed on the basis of their respective estimated fair values on the acquisition date, as follows:

The estimated useful economic lives of the identifiable intangible assets acquired in the Rent.com acquisition are six years for the customer list, five years for the trade name, three years for the developed technology, and one year for the user base.

Required:

A. Record the acquisition of Rent.comon eBay’s books (including the acquisition-related costs). (Assume that the net tangible assets of 18,050 equals the book value of Rent.com.)

B. Prepare the journal entry to eliminate the investment account and allocate any difference between fair value and purchase price.

C. Record any amortization of intangibles assuming that the cost basis is used by eBay (assume a full year of amortization for all intangibles). Where are these entries recorded?

Would your answer change if the complete equity method were used?

D. Is it likely in the first year that earnings per share will be dilutive or accretive?

An intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented...

Step by Step Answer: