Ornamental Iron Works began January with 45 units of iron inventory that cost $ 24 each. During

Question:

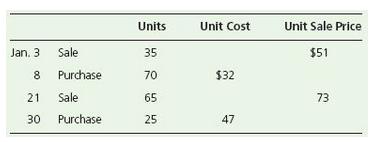

Ornamental Iron Works began January with 45 units of iron inventory that cost $ 24 each. During January, the company completed the following inventory transactions:

Requirements

1. Prepare a perpetual inventory record for the merchandise inventory using the FIFO inventory costing method.

2. Prepare a perpetual inventory record for the merchandise inventory using the LIFO inventory costing method.

3. Prepare a perpetual inventory record for the merchandise inventory using the weighted-average inventory costing method.

4. Determine the company’s cost of goods sold for January using FIFO, LIFO, and weighted-average inventory costing methods.

5. Compute gross profit for January using FIFO, LIFO, and weighted-average inventory costing methods.

6. If the business wanted to maximize gross profit, which method would it select?

Step by Step Answer:

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura