ParentCo owns all of the stock of DaughterCo, and the group files its Federal income tax returns

Question:

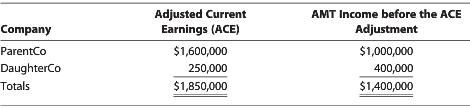

ParentCo owns all of the stock of DaughterCo, and the group files its Federal income tax returns on a consolidated basis. Both taxpayers are subject to the AMT this year due to active operations in oil and gas development. No intercompany transactions were incurred this year. If the affiliates filed separate returns, they would report the following amounts.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted: