Pat Corporation purchased 40 percent of the voting stock of Sue Corporation on July 1, 2011, for

Question:

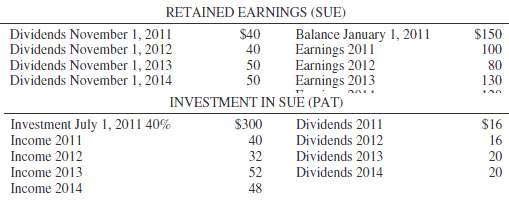

Pat Corporation purchased 40 percent of the voting stock of Sue Corporation on July 1, 2011, for $300,000. On that date, Sue's stockholders' equity consisted of capital stock of $500,000, retained earnings of $150,000, and current earnings (just half of 2011) of $50,000. Income is earned proportionately throughout each year. The Investment in Sue account of Pat Corporation and the retained earnings account of Sue Corporation for 2011 through 2014 are summarized as follows (in thousands):

REQUIRED1. Determine the correct amount of the investment in Sue that should appear in Pat's December 31, 2014, balance sheet. Assume any difference between investment cost and book value acquired is due to a building with a 10-year remaining life.2. Prepare any journal entry (entries) on Pat's books to bring the Investment in Sue account up to date on December 31, 2014, assuming that the books have not been closed at year-end2014.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith