Pelican Systems Inc. (PSI), a public company, develops and manufactures equipment that is sold to technology, communications,

Question:

Pelican Systems Inc. (PSI), a public company, develops and manufactures equipment that is sold to technology, communications, and airline enterprises, and designs and installs customized information networks for customers. The chief executive officer (CEO) of PSI retired on December 31, 20X4, and Gerald Cinco was hired as his replacement. An executive search firm recommended Cinco and he signed a three- year employment contract with PSI that includes performance bonuses. At the annual shareholders’ meeting held on March 6, 20X5, Cinco predicted strong growth in revenue and in earnings per share, which would result in a healthy increase in the value of PSI’s shares.

Cinco’s predictions were validated by PSI’s results as reflected in its audited financial statements for the fiscal year ended December 31, 20X5, and a substantial increase in the share value from the preceding year- end share value.

Following its policy of appointing new auditors every five years, at the annual shareholders’ meeting held on March 5, 20X6, Sharp & Ipson, Chartered Accountants LLP ( S& I), was appointed as auditor for the year ending December 31, 20X6.

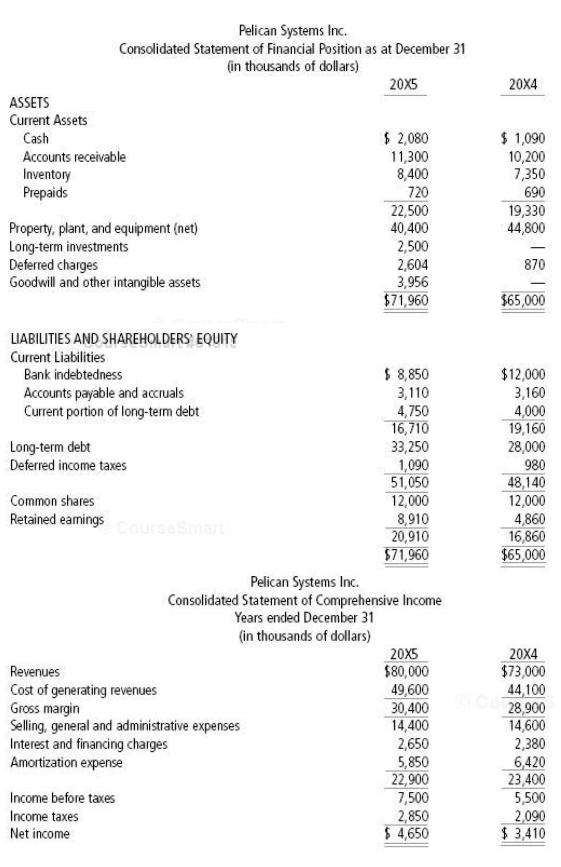

It is now March 17, 20X6. You are a CA with S& I and have been assigned the responsibility for the PSI audit engagement. You have obtained the extracts from the consolidated financial statements for the year ended December 31, 20X5 ( Exhibit A), information pertaining to the operations and accounting policies of PSI gathered through interviews with company employees ( Exhibit B), and extracts from the audit working papers prepared by the predecessor auditor ( Exhibit C).

The partner responsible for the PSI audit will be attending a meeting of the board of directors on March 26, 20X6. The partner has asked you to prepare a memo to help her under-stand the impact of the accounting policies followed in the prior year.

Required

Prepare the memo requested by the partner.

Exhibit A Extracts from Consolidated Financial Statements

.:.

Exhibit B Information Pertaining to the Operations and Accounting Policies of PSI

SALES LEASING PROGRAM

To stimulate sales, PSI sells customized equipment on a leasing basis, whereby an unrelated financial institution purchases the equipment from PSI and leases this equipment to PSI’s customers. PSI arranges sales on this basis for higher credit- risk customers. This sales practice was adopted effective April 1, 20X5, as directed by the CEO “to expand our customer base to meet our objective of sales and earnings growth.”

PSI pays a financing arrangement fee of 10% of the selling price of the equipment to the financial institution as compensation for extending a lower interest rate to the customer than would be typical for the credit risk related to the customer. PSI guarantees the payments of the customers. The financial institution holds title to the equipment until the final lease payment is made, at which time title is transferred to the lessee. PSI has the right to purchase each of the lease receivables from the financial institution at any time for the amount of the outstanding balance. The financing arrangement fee is not refundable.

During the fiscal year ended December 31, 20X5, sales totaling $ 12,000,000 were made under the terms of this leasing program, which provided PSI with a cash flow of $ 10,800,000 net of the financing arrangement fee paid to the financial institution. PSI’s gross margin on these sales, before the financing arrangement fee, was $ 5,400,000.

PSI’s director of marketing stated that, in January 20X6, the financial institution advised PSI that $ 1,600,000 of the $ 2,000,000 principal portion of the payments due by December 31, 20X5, had been made by the lessees and requested compensation of $ 400,000 plus interest of $ 24,000 for payments in arrears.

ACQUISITION OF EQUIPMENT

On July 1, 20X5, PSI acquired state- of- the- art technology equipment that is being used to manufacture a new product line under a special financing arrangement. PSI is required to pay to the seller 15% of the profit, defined as gross margin, realized from sales of this product line during the three years ending August 31, 20X8. PSI is required to remit the amount due annually no later than November 30 of each year, with the amount supported by “a certification by PSI’s auditor that PSI has remitted in full the amount due under the terms of the financing arrangement.”

According to PSI’s director of procurements, the cost to PSI to purchase the equipment for cash would have been $ 3,000,000. Revenue from sales of the new product line is projected to total $ 65,000,000 for the three years ending August 31, 20X8, as follows: first year, $ 19,500,000; second year, $ 27,300,000; third year, $ 18,200,000; and for the fourth and fifth years combined $ 25,000,000. The life of the product line is estimated to be five years. The projected gross margin is 40%. Sales of the new product line commenced on September 1, 20X5, and totaled $ 6,500,000 for the four months ended December 31, 20X5, and generated a gross margin of $ 2,600,000. This product line is often included in a “bundle of equipment” sold to customers and a portion of the selling price of the “bundle” is allocated internally to this product line.

PSI’s accounting policy is to recognize the amount payable to the seller annually on August 31 as a charge to the cost of generating revenues. No amount was accrued at December 31, 20X5.

SALE OF SUBSIDIARY

On November 1, 20X5, PSI sold a wholly owned subsidiary, Ersatz Technologies Inc. (ETI), and realized a gain of $ 1,600,000 on the sale. The gain was included in selling, general, and administrative expense (SG& A) in PSI’s SCI and was not separately disclosed. PSI’s annual report for fiscal 20X5 included a statement that the corporation had “ achieved its goal of improvements in efficiency and cost control by reducing SG& A to 18% of sales revenue from its previous level of 20%.”

INVESTMENT IN H& P

In February 20X5, PSI invested $ 2,500,000 in Hope & Pratt Ltd. (H& P), a publicly traded dot- com enterprise. This represented a 10% stake in the 25,000,000 shares issued. By May 20X5, H& P’s shares were trading at a market price of $ 60 amar-ketpriceof$60 per amarketpriceof$60per share. On December 31, 20X5, H& P’s shares were trading at $ 20 per share and had dropped to $ 5 per share by February 1, 20X6, as a result of financial warnings issued by H& P. H& P’s shares are currently trading at $ 4 per share. H& P reported a loss of $ 9,800,000 for the year ended December 31, 20X5.

ACQUISITION OF ATI

Effective September 1, 20X5, PSI acquired 100% ownership of AvanTemps Inc. (ATI) at a cost of $ 6,000,000. PSI determined its offering price as follows:

• fair value of ATI’s net tangible assets, $ 2,044,000;

• $ 1,500,000 payment to Ethan Brodsky (who owned 51% of the shares of ATI, is the founder of ATI, and is responsible for the development of ATI’s advanced technologies) for entering into a three year employment contract with PSI;

• $ 456,000 for unused non- capital losses totaling $ 1,200,000 at a tax rate of 38%; and

• $ 2,000,000 to reflect the value of ATI’s business.

Brodsky was also granted stock options for shares of PSI.

Based on ATI’s profitability in the first quarter of fiscal 20X6 and on projected profitability in the future, the treasurer advised you that the benefit of the unused tax losses will be recognized as a reduction in income tax expense in fiscal 20X6.

Exhibit C Extracts from Working Papers Prepared by Predecessor Auditor

a. Materiality was set at $ 1,000,000 based on projected revenue for fiscal 20X5.

b. Inherent risk was noted as “greater than in previous years for fiscal 20X5 because of the new CEO’s objective of reporting earnings growth and because of the risk

c. The working papers pertaining to the new sales leasing program include the following information:

• PSI’s accounting policy is to recognize the profit on these sales at the date of sale to the financial institution that acts as a lessor to PSI’s customers and to recognize the cost of the payment guarantees as paid to the financial institution. PSI accrued a $ 424,000 liability on December 31, 20X5, and included this amount in accounts payable based on notification by the financial institution of customer payments in arrears. PSI remitted this amount, which includes interest of $ 24,000, to the financial institution on January 31, 20X6. The CA concluded that PSI’s accounting policy is acceptable because title to the equipment is transferred to the financial institution and the cost of the payment guarantee is reflected in PSI’s financial statements.

• PSI’s accounting policy is to defer and amortize the financing arrangement fee over the three- year term of the leases. Amortization of $ 200,000 of the $ 1,200,000 in fees incurred in fiscal 20X5 is included in the “interest and financing charges” SCI account and the unamortized balance of $ 1,000,000 is included in the “deferred charges” SFP account.

d. A working paper noted that the determination of the gain on the sale of ETI had been verified and that PSI had received the full amount of the proceeds from the sale.

e. A working paper noted that the treasurer had informed the auditor that “it is too early to determine whether or not the loss in value of the H& P investment is other than a temporary decline.” He is hopeful for a turnaround by H& P.

f. A working paper pertaining to the acquisition of ATI includes the following information: An intangible asset in the amount of $ 1,500,000 has been recognized for the employment contract and is considered to have an indefinite life until such time as Brodsky announces his intention to leave PSI.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay