Pendleton Enterprises began operations on January 1, 2013. Balance sheet and income statement information for 2013, 2014,

Question:

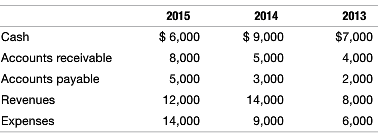

Pendleton Enterprises began operations on January 1, 2013. Balance sheet and income statement information for 2013, 2014, and 2015 follow:

REQUIRED:

a. Prepare the operating sections of the statement of cash flows for 2013, 2014, and 2015 under the direct method.

b. Assume that the $4,000 of outstanding accounts receivable on December 31, 2013, was actually collected before the end of 2013 but that the accounts receivable balances for 2014 and 2015 are unchanged.

Prepare the statements of cash flows under the direct method for all three years.

c. Ignore the assumption in (b), and assume alternatively that the company deferred an additional $3,000 on the payment of accounts payable as of December 31, 2013 (i.e., accounts payable equal $5,000, and cash equals $10,000 on December 31, 2013). The accounts receivable balances for 2014 and 2015 are unchanged. Prepare the operating section of the statements of cash flows for all three periods.

d. How can managers manipulate cash provided (used) by operations, and what usually happens in the subsequent period?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: