Pool Scrubbers manufactures three different models of swimming pool cleaners ( 710, 720, and 830). These are

Question:

Pool Scrubbers manufactures three different models of swimming pool cleaners ( 710, 720, and 830). These are sophisticated computer- controlled, programmed cleaners that scrub and vacuum the pool’s bottom, walls, and steps and provide supplemental filtration of pool water. The three models differ in their capacity and programmability.

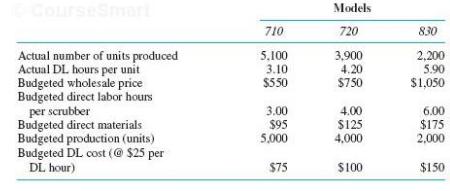

Pool Scrubbers uses an absorption costing system that absorbs manufacturing overhead to the three models based on direct labor hours. The single plantwide manufacturing overhead rate is predetermined before the beginning of the fiscal year using a flexible manufacturing over-head budget. Variable manufacturing overhead is budgeted to be $ 3.00 per direct labor hour, and fixed manufacturing overhead is budgeted to be $ 1.4 million. Direct labor is budgeted at $ 25 per direct labor hour. The following table summarizes the budgeted and actual results of operation for the year:

Required:

a. Calculate the firmwide overhead rate for the year (round to four decimals). The overhead rate is calculated before the fiscal year begins.

b. A batch of 100 units of model 720 is produced using 405 direct labor hours. How much overhead is absorbed by this batch of 100 model 720s?

c. Actual overhead incurred during the year was $ 1,520,500. Calculate the amount of over-or underabsorbed overhead for the year.

d. Scrubbers writes off any over/ underabsorbed overhead to cost of goods sold. What is the effect on earnings of writing off the over/ underabsorbed overhead calculated in part ( c ) above on net income? In other words, does net income increase or decrease relative to what net income was prior to the write- off of the over/ underabsorbed overhead calculated in part ( c ) above?

Step by Step Answer:

Accounting for Decision Making and Control

ISBN: 978-0078025747

8th edition

Authors: Jerold Zimmerman