Power Corporation acquired 70 percent of Silk Corporations common stock on December 31, 20X2. Balance sheet data

Question:

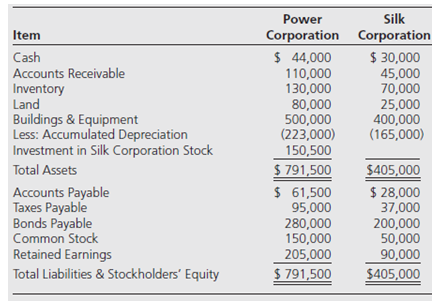

Power Corporation acquired 70 percent of Silk Corporation’s common stock on December 31, 20X2. Balance sheet data for the two companies immediately following the acquisition follow:

At the date of the business combination, the book values of Silk’s net assets and liabilities approximated fair value except for inventory, which had a fair value of $85,000, and land, which had a fair value of $45,000. The fair value of the noncontrolling interest was $64,500 on December 31, 20X2.

Required

For each question below, indicate the appropriate total that should appear in the consolidated balance sheet prepared immediately after the business combination.

1. What amount of inventory will be reported?

a. $179,000.

b. $200,000.

c. $210,500.

d. $215,000.

2. What amount of goodwill will be reported?

a. $0.

b. $28,000.

c. $40,000.

d. $52,000.

3. What amount of total assets will be reported?

a. $1,081,000.

b. $1,121,000.

c. $1,196,500.

d. $1,231,500.

4. What amount of total liabilities will be reported?

a. $265,000.

b. $436,500.

c. $622,000.

d. $701,500.

5. What amount will be reported as noncontrolling interest?

a. $42,000.

b. $52,500.

c. $60,900.

d. $64,500.

6. What amount of consolidated retained earnings will be reported?

a. $295,000.

b. $268,000.

c. $232,000.

d. $205,000.

7. What amount of total stockholders’ equity will be reported?

a. $355,000.

b. $397,000.

c. $419,500.

d. $495,000.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0078025624

10th edition

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker