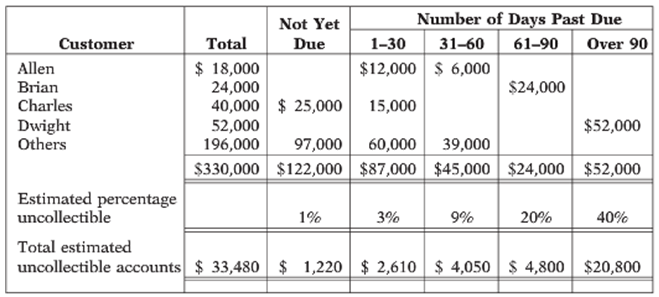

Presented below is an aging schedule for Harper Company. At December 31, 2013, the unadjusted balance in

Question:

Presented below is an aging schedule for Harper Company.

At December 31, 2013, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $9,000.

Instructions

(a) Journalize and post the adjusting entry for bad debts at December 31, 2013. (Use T-accounts.)

(b) Journalize and post to the allowance account these 2014 events and transactions:

1. February 1, a $900 customer balance originating in 2013 is judged uncollectible.

2. July 1, a check for $900 is received from the customer whose account was writ-ten off as uncollectible on February 1.

(c) Journalize the adjusting entry for bad debts at December 31, 2014, assuming that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $2,800 and the aging schedule indicates that total estimated uncollectible accounts will be $30,600.

Aging schedule is an accounting table that shows a company’s account receivables. It is an summarized presentation of accounts receivable into a separate time brackets that the rank received based upon the days due or the days past due. Generally...

Step by Step Answer:

Accounting Tools for Business Decision Making

ISBN: 978-1118128169

5th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso