Prime Personal Trainers is a personal training service in Belgium for people who want to work out

Question:

Prime Personal Trainers is a personal training service in Belgium for people who want to work out at home. Prime offers two different types of services: Setup and Continuous Improvement. Setup services consist of several home visits by a personal trainer who specializes in determining the proper equipment for each client and helping the client set up a home gym. Continuous Improvement services provide daily, weekly, or biweekly home visits by trainers.

Prime’s accountant wants to create a job costing system for Setup services. She decides to use direct labor cost as the allocation base for variable overhead costs, and direct labor hours for fixed overhead cost. To estimate normal capacity, she calculates the average direct labor cost over the last several years. She estimates overhead by updating last year’s overhead cost with expected increases in rent, supervisor’s salaries, and so on. Following are her estimates (given in Euros) for the current period.

Direct labor hours (based on 250 normal hours per month) …… 3,000

Direct labor cost …………..………………………………….........................…. € 75,000

Variable overhead (primarily fringe benefits) ……………..........……. 150,000

Fixed overhead (office related costs) ……………………….............…… 120,000

Inventories consist of exercise equipment and supplies that are used by Prime for new clients.

The following information summarizes operations during the month of October. A number of new jobs were begun in October, but only two jobs were completed: Job 20 and Job 22.

Account balances on October 1:

Equipment and supplies (raw materials) ……… €5,000

Client contracts in process (Job 20) ………………. 3,500

Client contracts in process (Job 22) ………………. 1,500

Purchases of equipment and supplies:

Equipment ………. €54,000

Supplies …………. 500

Total ………...…….. €54,500

Equipment and supplies requisitioned for clients:

Job 20 ………… € 1,000

Job 21 …………. 500

Job 22 ………….. 4,000

Job 23 ………….. 5,000

Other jobs ………. 40,000

Indirect supplies …. 500

Total …………. €51,000

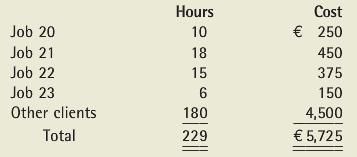

Direct labor hours and cost:

Labor costs:

Direct labor wages …………………….......... € 5,725

Indirect labor wages (160 hours) ……… 1,920

Manager’s salary …………………........……. 6,250

Total …………………………………..............… €13,895

REQUIRED

A. What are the estimated allocation rates for fixed and variable overhead for the current period?

B. What is the total overhead cost allocated to Job 20 in October?

C. What is the total cost of Job 20?

D. Calculate the amounts of fixed and variable overhead allocated to jobs in October.

E. Why would the accountant choose to use two cost pools instead of one? Will this method make a difference in client bills when the job includes more equipment and less labor than other jobs?

Step by Step Answer:

Cost Management Measuring Monitoring and Motivating Performance

ISBN: 978-0470769423

2nd edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott