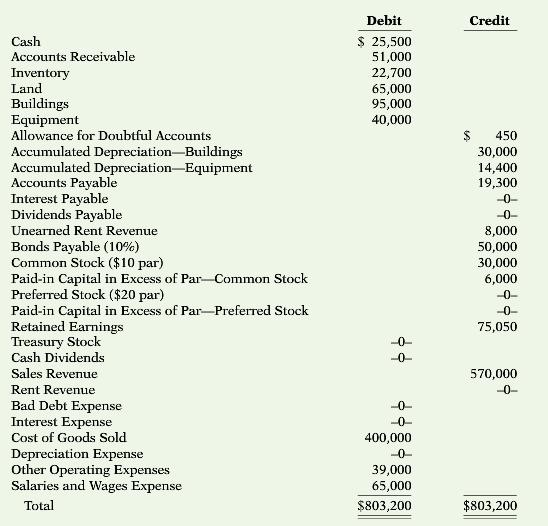

Quigley Corporations trial balance at December 31, 2017, is presented below. All 2017 transactions have been recorded

Question:

Quigley Corporation’s trial balance at December 31, 2017, is presented below. All 2017 transactions have been recorded except for the items described below.

Unrecorded transactions and adjustments:

1. On January 1, 2017, Quigley issued 1,000 shares of $20 par, 6% preferred stock for $22,000.

2. On January 1, 2017, Quigley also issued 1,000 shares of common stock for $23,000.

3. Quigley reacquired 300 shares of its common stock on July 1, 2017, for $49 per share.

4. On December 31, 2017, Quigley declared the annual cash dividend on the preferred stock and a $1.50 per share dividend on the outstanding common stock, all payable on January 15, 2018.

5. Quigley estimates that uncollectible accounts receivable at year-end is $5,100.

6. The building is being depreciated using the straight-line method over 30 years. The salvage value is $5,000.

7. The equipment is being depreciated using the straight-line method over 10 years. The salvage value is $4,000.

8. The unearned rent was collected on October 1, 2017. It was the receipt of 4 months’ rent in advance (October 1, 2017 through January 31, 2018).

9. The 10% bonds payable pay interest every January 1. The interest for the 12 months ended December 31, 2017, has not been paid or recorded.

Instructions (Ignore income taxes.)

(a) Prepare journal entries for the transactions and adjustment listed above.

(b) Prepare an updated December 31, 2017, trial balance, recording the journal entries in (a).

(c) Prepare a multiple-step income statement for the year ending December 31, 2017.

(d) Prepare a retained earnings statement for the year ending December 31, 2017.

(e) Prepare a classified balance sheet as of December 31, 2017.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Accounting Principles

ISBN: 978-1118875056

12th edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso