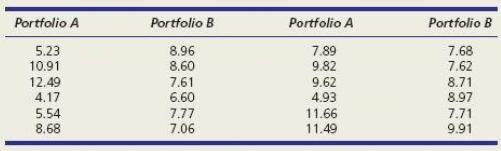

Rates of return (annualized) in two investment portfolios are compared over the last 12 quarters. They are

Question:

Rates of return (annualized) in two investment portfolios are compared over the last 12 quarters. They are considered similar in safety, but portfolio B is advertised as being "less volatile."

(a) At α = .025, does the sample show that portfolio A has significantly greater variance in rates of return than portfolio B?

(b) At α = .025, is there a significant difference in the means?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Applied Statistics In Business And Economics

ISBN: 9780073521480

4th Edition

Authors: David Doane, Lori Seward

Question Posted: