Refer to the data for Gore Range Carpet Cleaning in Problem 8-21. Required: 1. Using Exhibit 8A1

Question:

Refer to the data for Gore Range Carpet Cleaning in Problem 8-21.

Required:

1. Using Exhibit 8A–1 as a guide, prepare the first-stage allocation of costs to the activity cost pools.

2. Using Exhibit 8A–2 as a guide, compute the activity rates for the activity cost pools.

3. The company recently completed a 6 hundred square-foot carpet-cleaning job at the Lazy Bee

Ranch—a 52-mile round-trip journey from the company’s offices in Eagle-Vail. Compute the cost of this job using the activity-based costing system.

4. The revenue from the Lazy Bee Ranch was $137.70 (6 hundred square-feet at $22.95 per hundred square feet). Using Exhibit 8A–5 as a guide, prepare an action analysis report of the Lazy Bee Ranch job. The president of Gore Range Carpet Cleaning considers all of the company’s costs to be Green costs except for office expenses, which are coded Yellow, and his own compensation, which is coded Red. The people who do the actual carpet cleaning are all trained part-time workers who are paid only for work actually done.

5. What do you conclude concerning the profitability of the Lazy Bee Ranch job? Explain.

6. What advice would you give the president concerning pricing jobs in the future?

Data from Problem 8-21.

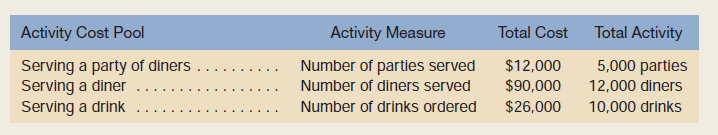

The above costs include all of the costs of the restaurant except for organization-sustaining costs such as rent, property taxes, and top-management salaries. A group of diners who ask to sit at the same table are counted as a party. Some costs, such as the costs of cleaning linen, are the same whether one person is at a table or the table is full. Other costs, such as washing dishes, depend on the number of diners served. Prior to the activity-based costing study, the owner knew very little about the costs of the restaurant. He knew that the total cost for the month (including organization-sustaining costs) was $180,000 and that 12,000 diners had been served. Therefore, the average cost per diner was $15.

Step by Step Answer:

Managerial Accounting

ISBN: 9780073526706

12th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer