Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4. What is

Question:

Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4. What is the project’s NPV (round to nearest dollar)? Is the investment attractive? Why or why not?

Data from Short Exercise S26- 4.

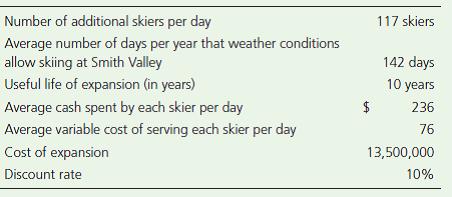

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valley’s managers developed the following estimates concerning the expansion:

Assume that Smith Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $1,000,000 at the end of its 10-year life.

Number of additional skiers per day 117 skiers Average number of days per year that weather conditions allow skiing at Smith Valley 142 days Useful life of expansion (in years) 10 years Average cash spent by each skier per day $ 236 Average variable cost of serving each skier per day 76 Cost of expansion 13,500,000 Discount rate 10%

Step by Step Answer:

Time Net Cash Inflow Annuity PV Factor i 10 n 10 PV Factor i 10 n 10 Present Value ...View the full answer

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Corporate Finance questions

-

Refer to the Smith Valley Snow Park Lodge expansion project in S21-2. Requirement 1. Compute the payback period for the expansion project.

-

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valleys managers developed...

-

Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4 and your calculations in Short Exercises S26- 5 and S26- 6. Assume the expansion has zero residual value. Data...

-

In each of the homeowners forms, OA) the property coverage is the same OB) the liability coverage varies OC) both the property and liability coverage are the same OD) the property coverage varies

-

Use the VSEPR method to predict the geometry of the following ion and molecules: a. ClO3; b. OF2; c. SiF4.

-

A firm is expected to pay a dividend of $1.35 next year and $1.50 the following year. Financial analysts believe the stock will be at their price target of $68 in two years. Compute the value of this...

-

For the multiple linear regression model, show that $S S_{\mathrm{R}}(\boldsymbol{\beta})=\mathbf{y}^{\prime} \mathbf{H y}$.

-

1. As stated in the case, The New York Times chose to deploy their innovation support group as a shared service across business units. What do you think this means? What are the advantages of...

-

a. If my car needs $1,200 in repairs today, do I have enough to cover the cost? b. If my job frequently requires me to work late or on weekends, is it worth it to pay additional money for premium...

-

Dry Quick (DQ) is a medium-sized, private manufacturing company located near Timmins, Ontario. DQ has a June 30 year-end. Your firm, Poivre & Sel (P&S), has recently been appointed as auditors forDQ....

-

Your grandfather would like to share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose): 1. $ 8,750 per year at the end of each of the...

-

Refer to Short Exercise S26-4. Assume the expansion has no residual value. What is the projects NPV (round to nearest dollar)? Is the investment attractive? Why or why not? Data from Short Exercise...

-

What is reference pricing, and how is it used by customers? Give an example.

-

Write a brief evaluation of the following secondary information sources: A well-known popular daily financial newspaper A well-recognized global market research organization with a reputation for...

-

The anniversary date of the founding of the first store in the chain where you work as marketing manager is coming up. Across the globe, the chain has 186 stores with just over 322,000 customer...

-

You appreciate how important phones are to your companys operations, but the amount of conversational chatter in your work area has gotten so bad that its hard to concentrate on your work. You...

-

Why is it important to be conscious of the listening style you are using during any phase of a conversation or presentation?

-

Now that youve explored routine, positive, negative, and persuasive messages, review the following message scenarios and identify which of the four message strategies would be most appropriate for...

-

A newly discovered planet has twice the mass and three times the radius of the earth. What is the free-fall acceleration at its surface, in terms of the free-fall acceleration g at the surface of the...

-

What are the two components of a company's income tax provision? What does each component represent about a company's income tax provision?

-

Using a CPU that runs an operating system that uses RMS, try to get the CPU utilization up to 100%. Vary the data arrival times to test the robustness of the system.

-

Nature Foods Grocery reported the following comparative income statements for the years ended June 30, 2019 and 2018: During 2019, Nature Foods Grocery discovered that ending 2018 merchandise...

-

Calm Day reported the following income statement for the year ended December 31, 2019: Requirements 1. Compute Calm Day's inventory turnover rate for the year. (Round to two decimal places.) 2....

-

Calm Day reported the following income statement for the year ended December 31, 2019: Requirements 1. Compute Calm Day's inventory turnover rate for the year. (Round to two decimal places.) 2....

-

Explain why leasing is an option for a company expansion. include, what leasing is and how it will benefit the company in it's expanding efforts. Also, how is capital or operating leasing recorded on...

-

Discuss the following statement: " A head of state signs a treaty on behalf of his country in excess of authority of his country, such treaty shal be void for inconsistency with domestic law of the...

-

A company is looking at new equipment with an installed cost of $415,329. This cost will be depreciated straight-line to zero over the project's 5-year life, at the end of which the equipment can be...

Study smarter with the SolutionInn App