Referring to Problem 5.6, what would happen if you constructed a portfolio consisting of assets A, B,

Question:

Referring to Problem 5.6, what would happen if you constructed a portfolio consisting of assets A, B, and C, equally weighted? Would this reduce risk or enhance return?

Data from Problem 5.6

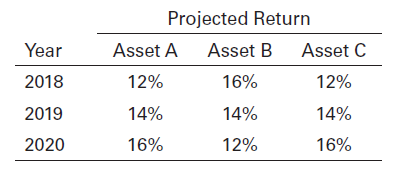

You have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data.

You have been told that you can create two portfolios—one consisting of assets A and B and the other consisting of assets A and C—by investing equal proportions (50%) in each of the two component assets.

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investing

ISBN: 9780134083308

13th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

Question Posted: