Ridgemont acquired 90% of the common shares of Gourmand on January 1, 2009, at a cost of

Question:

Ridgemont acquired 90% of the common shares of Gourmand on January 1, 2009, at a cost of $150,750. At that date the equity of Gourmand was:

Share capital (100,000 shares) .....$100,000

Retained earnings ......... 20,000

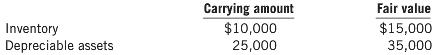

At January 1, 2009, all the identifiable assets and liabilities of Gourmand were at fair value except for the following assets:

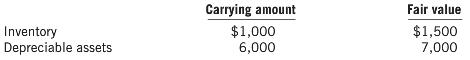

The inventory was all sold by December 31, 2009. Depreciable assets have an expected further five-year life, with depreciation being calculated on a straight-line basis. Ridgemont uses the partial goodwill method. On January 1, 2012, Gourmand acquired 25% of the capital of Primo for $3,500. All the identifiable assets and liabilities of Primo were recorded at fair value except for the following:

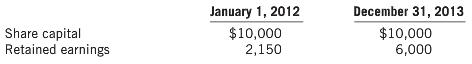

All this inventory was sold in the 12 months after January 1, 2012. The depreciable assets were considered to have a further five-year life. Information on Primo€™s equity position is as follows:

For the year ended December 31, 2013, Primo recorded a profit before tax of $2,600 and an income tax expense of $600. Primo paid a dividend of $200 in June 2013. Ridgemont regards Primo as a joint venture. During the year ended December 31, 2013, Primo sold inventory to Gourmand for $6,000. The cost of this inventory to Primo was $4,000. Gourmand has resold only 20% of these items. However, Gourmand made a profit before tax of $500 on the resale of these items.

On June 30, 2012, Gourmand sold Primo a motor vehicle for $4,000, at a profit before tax of $800 to Gourmand. Both companies treat motor vehicles as non-current assets. Both companies charge depreciation at 20% p.a. on cost straight line. Assume a tax rate of 30%. Information about income and changes in equity for Ridgemont and its subsidiary, Gourmand, for the year ended December 31, 2013, is as follows:

-4.png)

Required

(a) Prepare the consolidated statement of comprehensive income and statement of changes in equity of Ridgemont and its subsidiary Gourmand as at December 31, 2013. Ridgemont€™s share capital is $100,000.

(b) In the consolidated statement of financial position, what would be the balance of the investment in Primo as at December 31, 2013?

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer: