ROI, measurement alternatives for performance measures P. F. Skidaddle's operates casual dining restaurants in three regions: Denver,

Question:

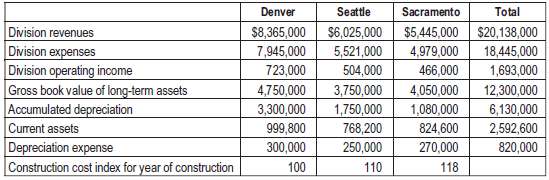

ROI, measurement alternatives for performance measures P. F. Skidaddle's operates casual dining restaurants in three regions: Denver, Seattle, and Sacramento. Each geographic market is considered a separate division. The Denver division is made up of four restaurants, each built in early 2002. The Seattle division is made up of three restaurants, each built in January 2006. The Sacramento division is the newest, consisting of three restaurants built four years ago. Division managers at P. F. Skidaddle's are evaluated on the basis of ROI. The following information refers to the three divisions at the end of 2012:

Required1. Calculate ROI for each division using net book value of total assets.2. Using the technique in Exhibit 23-2, compute ROI using current-cost estimates for long-term assets and depreciation expense. Construction cost index for 2012 is 122. Estimated useful life of operational assets is 15 years.3. How does the choice of long-term asset valuation affect management decisions regarding new capital investments? Why might this be more significant to the Denver division manager than to the Sacramento divisionmanager?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0132109178

14th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav