Samba is a popular restaurant located in Brazilton Resort. Management feels that enlarging the facility to incorporate

Question:

Samba is a popular restaurant located in Brazilton Resort. Management feels that enlarging the facility to incorporate a large outdoor seating area will enable Samba to continue to attract existing customers as well as handle large banquet parties that now must be turned away. Two proposals are currently under consideration. Proposal A involves a temporary walled structure and umbrellas used for sun protection; Proposal B entails a more permanent structure with a full awning cover for use even in inclement weather. Although the useful life of each alternative is estimated to be 10 years, Proposal B results in higher salvage value due to the awning protection. The accounting department of Brazilton Resort and the manager of Samba have assembled the following data regarding the two proposals:

-1.png)

Instructions

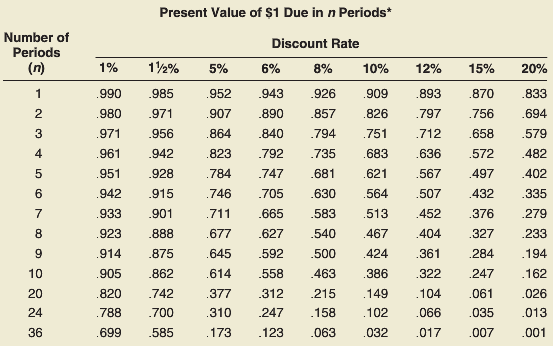

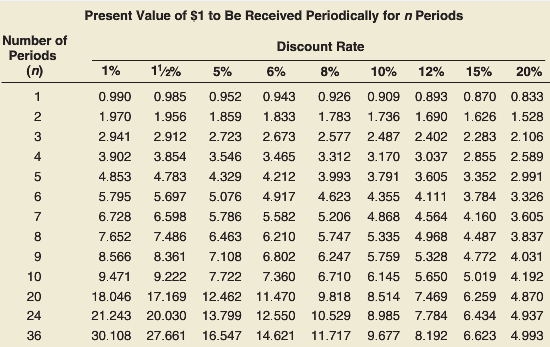

a. For each proposal, compute the (1) payback period, (2) return on average investment, and (3) net present value discounted at management’s required rate of return of 10 percent. (Round the payback period to the nearest tenth of a year and the return on investment to the nearest tenth of a percent.) Use Exhibits 26–3 and 26–4 where necessary.

b. Based on your analysis in part a, which proposal would you recommend? Explain the reasons for your choice.

In Exhibits 26–3

In Exhibits 26–4

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078111044

16th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello