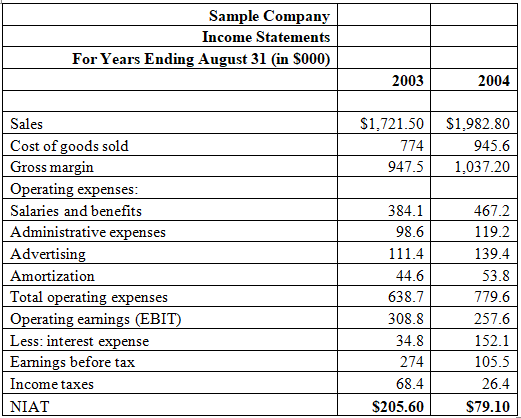

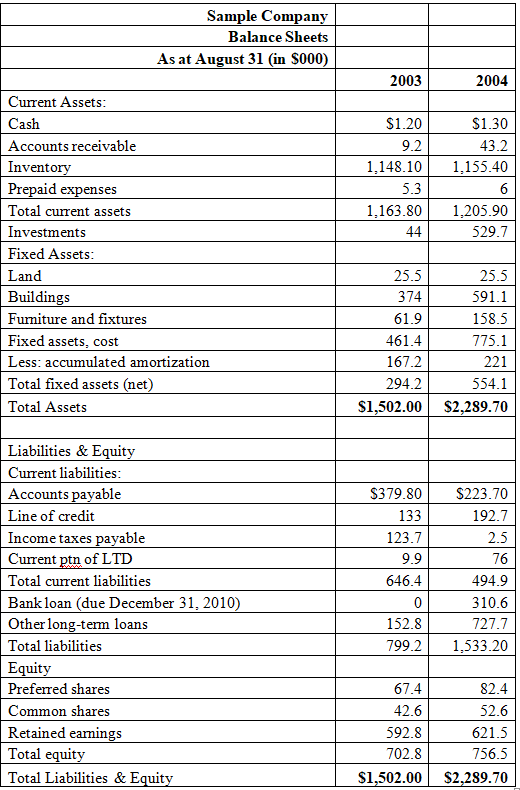

Sample Company is an aerospace manufacturer located in summer side, PEI. The company's income statements and balance

Question:

Sample Company is an aerospace manufacturer located in summer side, PEI. The company's income statements and balance sheets for the fiscal years ended August 31, 2003 and 2004 are attached.

1) In 2003, the company had 12,000 preferred shares and 122,300 common shares outstanding. In 2004, Sample Company sold 1,500 preferred and 800 common shares. The company pays a dividend of $1 per share on the preferred shares. In 2003, Sample Company paid common share dividends of $36,690.

2) Sample Company is a CCPC and is a manufacturer. The amount of CCA the company could claim in 2003 and 2004 was $36,120 and $71,485 respectively.

Use the statements provided in a separate Excel file, Sample Company.xls, to determine the following. Be sure to show your work.

(a) The total dollar investment in assets made during 2004 and the sources of the funds invested.

(b) The amortization expense in 2004 calculated using only the balance sheet.

(c) The stated value of the preferred shares sold in 2004.

(d) The company's earnings per share (EPS) in 2003 and2004.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Using Financial Accounting Information The Alternative to Debits and Credits

ISBN: 978-1133161646

7th Edition

Authors: Gary A. Porter, Curtis L. Norton