Select the correct answer for each of the following questions. 1. The following information applies to Denton

Question:

Select the correct answer for each of the following questions.

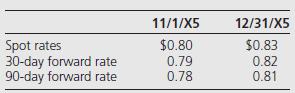

1. The following information applies to Denton Inc.’s sale of 10,000 foreign currency units under a forward contract dated November 1, 20X5, for delivery on January 31, 20X6:

Denton entered into the forward contract to speculate in the foreign currency. In its income statement for the year ended December 31, 20X5, what amount of loss should Denton report from this forward contract?

a. $400.

b. $300.

c. $200.

d. $0.

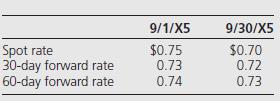

2. On September 1, 20X5, Johnson Inc. entered into a foreign exchange contract for speculative purposes by purchasing €50,000 for delivery in 60 days. The rates to exchange U.S. dollars for euros follow:

In its September 30, 20X5, income statement, what amount should Johnson report as foreign exchange loss?

a. $2,500.

b. $1,500.

c. $1,000.

d. $500.

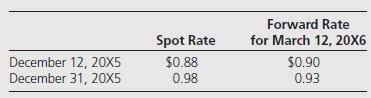

On December 12, 20X5, Dahl Company entered into three forward exchange contracts, each to purchase 100,000 francs in 90 days. The relevant exchange rates are as follows:

3. Dahl entered into the first forward contract to manage the foreign currency risk from a purchase of inventory in November 20X5, payable in March 20X6. The forward contract is not designated as a hedge. At December 31, 20X5, what amount of foreign currency transaction gain should Dahl include in income from this forward contract?

a. $0.

b. $3,000.

c. $5,000.

d. $10,000.

4. Dahl entered into the second forward contract to hedge a commitment to purchase equipment being manufactured to Dahl's specifications. At December 31, 20X5, what amount of foreign currency transaction gain should Dahl include in income from this forward contract?

a. $0.

b. $3,000.

c. $5,000.

d. $10,000.

5. Dahl entered into the third forward contract for speculation. At December 31, 20X5, what amount of foreign currency transaction gain should Dahl include in income from this forward contract?

a. $0.

b. $3,000.

c. $5,000.

d. $10,000.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0078025624

10th edition

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker