Select the correct answer for each of the following questions. 1. Which of the following is an

Question:

Select the correct answer for each of the following questions.

1. Which of the following is an inherent difficulty in determining the results of operations on an interim basis?

a. Cost of sales reflects only the amount of product expense allocable to revenue recognized as of the interim date.

b. Depreciation on an interim basis is a partial estimate of the actual annual amount.

c. Costs expensed in one interim period may benefit other periods.

d. Revenue from long-term construction contracts accounted for by the percentage-of-completion method is based on annual completion, and interim estimates may be incorrect.

2. Which of the following reporting practices is permissible for interim financial reporting?

a. Use of the gross profit method for interim inventory pricing.

b. Use of the direct costing method for determining manufacturing inventories.

c. Deferral of unplanned variances under a standard cost system until the following year.

d. Deferral of nontemporary inventory market declines until year-end.

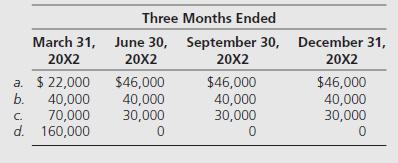

3. On January 1, 20X2, Harris Inc. paid $40,000 in property taxes on its plant for the calendar year 20X2. In March 20X2, Harris made $120,000 in annual major repairs to its machinery. These repairs will benefit the entire calendar year’s operations. How should these expenses be reflected in Harris’s quarterly income statements?

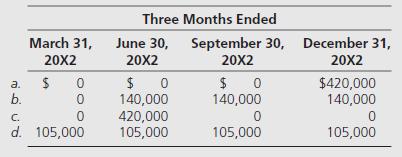

4. Wenger Company experienced a $420,000 inventory loss from market decline in April 20X2. The company recorded this loss in April 20X2 after its March 31, 20X2, quarterly report was issued. None of this loss was recovered by the end of the year. How should this loss be reflected in Wenger’s quarterly income statements?

5. A company that uses the last-in, first-out (LIFO) method of inventory costing finds at an interim reporting date that there has been a partial liquidation of the base-period inventory level. The decline is considered temporary, and the base inventory will be replaced before year-end. The amount shown as inventory on the interim reporting date should

a. Not consider the LIFO liquidation, and cost of sales for the interim reporting period should include the expected cost of replacement of the liquidated LIFO base.

b. Be shown at the actual level, and cost of sales for the interim reporting period should reflect the decrease in LIFO base-period inventory level.

c. Not consider the LIFO liquidations, and cost of sales for the interim reporting period should reflect the decrease in LIFO base-period inventory level.

d. Be shown at the actual level, and the decrease in inventory level should not be reflected in the cost of sales for the interim reporting period.

6. During the second quarter of 20X5, Camerton Company sold a piece of equipment at a $12,000 gain. What portion of the gain should Camerton report in its income statement for the second quarter of 20X5?

a. $12,000.

b. $6,000.

c. $4,000.

d. $0.

7. On March 15, 20X1, Burge Company paid property taxes of $180,000 on its factory building for calendar year 20X1. On April 1, 20X1, Burge made $300,000 in unanticipated repairs to its plant equipment. The repairs will benefit operations for the remainder of the calendar year. What total amount of these expenses should be included in Burge's quarterly income statement for the three months ended June 30, 20X1?

a. $75,000.

b. $145,000.

c. $195,000.

d. $345,000.

8. SRB Company had an inventory loss from a market price decline that occurred in the first quarter. The loss was not expected to be restored in the fiscal year. However, in the third quarter, the inventory had a market price recovery that exceeded the first-quarter decline. For interim financial reporting, the dollar amount of net inventory should

a. Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the market price recovery.

b. Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the decrease in the first quarter.

c. Not be affected in the first quarter and increase in the third quarter by the amount of the market price recovery that exceeded the amount of the market price decline.

d. Not be affected in either the first quarter or the third quarter.

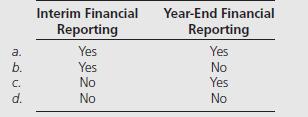

9. For external reporting purposes, it is appropriate to use estimated gross profit rates to determine the cost of goods sold for

10. On June 30, 20X5, Park Corporation incurred a $100,000 net loss from disposal of a business component. Also, on June 30, 20X5, Park paid $40,000 for property taxes assessed for calendar year 20X5. What amount of the preceding items should be included in the determination of Park’s net income or loss for the six-month interim period ended June 30, 20X5?

a. $140,000.

b. $120,000.

c. $90,000.

d. $70,000.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0078025624

10th edition

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker