Shellie??s Lawn and Gardening performs various lawn and garden maintenance activities, including lawn mowing, tree and shrub

Question:

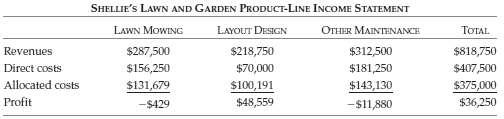

Shellie??s Lawn and Gardening performs various lawn and garden maintenance activities, including lawn mowing, tree and shrub pruning, fertilizing, and treating for pests. Unlike other lawn and garden businesses in the city, Shellie also specializes in landscape design and planting. Shellie is pleased that her design specialty is so much in demand. However, she is concerned because profits have been falling, even though sales have been growing during the past few years. In an effort to better understand why profits are falling, Shellie prepared the following product-line income statement:

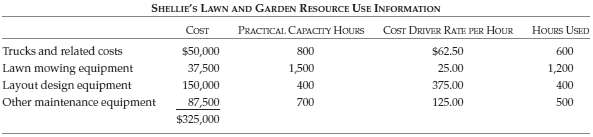

The lawn mowing business involves mowing lawns and trimming edges for customers who generally sign up for the season and pay a flat fee based on the surface area mowed and trimmed. The layout design business involves both designing a garden and lawn layout and installing the design. Other maintenance includes tree and shrub pruning and application of chemicals. The direct costs for each line of business are the costs of the materials and wages of the people who work in that line of business. The remaining costs consist mainly of equipment costs but also include office costs. After some deliberation, Shellie decided to allocate the remaining costs of $375,000 on the basis of revenue, reasoning that revenue is a measure of equipment use.Required(a) Based on this product-line income statement, which business is Shellie likely to focus her efforts on? What is the likely result?A further analysis of the allocated costs produced the information in the following table. General business costs are $50,000, and the remaining $325,000 represents equipment costs. The trucks are shared equally by all segments, but the other equipment is used by only the indicated segment.

(b) For each equipment category in the table above, calculate the cost allocated to Shellie??s service orders based on the number of hours used, and calculate the cost associated with unused capacity.(c) Prepare a new product-line income statement with a column for each product line and a column for the total company. For each product line, include the cost of used equipment capacity and the cost of unused capacity that is attributable only to that product line.(d) Based on your new product-line income statement, what advice do you have for Shellie? How does this advice compare to your response in parta?

Step by Step Answer:

Management Accounting Information for Decision-Making and Strategy Execution

ISBN: 978-0137024971

6th Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young