Simga Company's Turkish subsidiary reported the following amounts in Turkish lire (TL) on its December 31, Year

Question:

Simga Company's Turkish subsidiary reported the following amounts in Turkish lire (TL) on its December 31, Year 4, balance sheet:

Equipment ……………………………………….. TL 100,000,000,000

Accumulated depreciation (straight-line) ………… 32,000,000,000

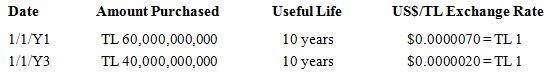

Additional information related to the equipment is as follows:

U.S.-dollar exchange rates for the Turkish lira for Year 4 are as follows:

January 1, Year 4 ………………. $0.0000010

December 31, Year 4 …………… 0.0000006

Required:

a. Assume that Turkey is a highly inflationary economy. Determine the amounts at which the Turkish subsidiary's equipment and accumulated depreciation should be reported on Simga Company's December 31, Year 4, consolidated balance sheet in accordance with U.S. GAAP. Determine the net book value for equipment.

b. Now assume that Turkey is not a highly inflationary economy and that the Turkish subsidiary primarily uses Turkish lire in conducting its operations. Determine the amounts at which the Turkish subsidiary's equipment and accumulated depreciation should be reported on Simga Company's December 31, Year 4, consolidated balance sheet in accordance with U.S. GAAP. Determine the net book value for equipment.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: