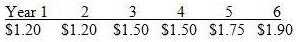

Spreadsheets are especially useful for computing stock value under different assumptions. Consider a firm that is expected

Question:

and grow at 5 percent thereafter

A. Using an 11 percent discount rate, what would be the value of this stock?

B. What is the value of the stock using a 10 percent discount rate? A 12 percent discount rate?

C. What would the value be using a 6 percent growth rate after year 6 instead of the 5 percent rate using each of these three discount rates?

D. What do you conclude about stock valuation and its assumptions?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Finance Applications and Theory

ISBN: 978-0077861681

3rd edition

Authors: Marcia Cornett, Troy Adair

Question Posted: