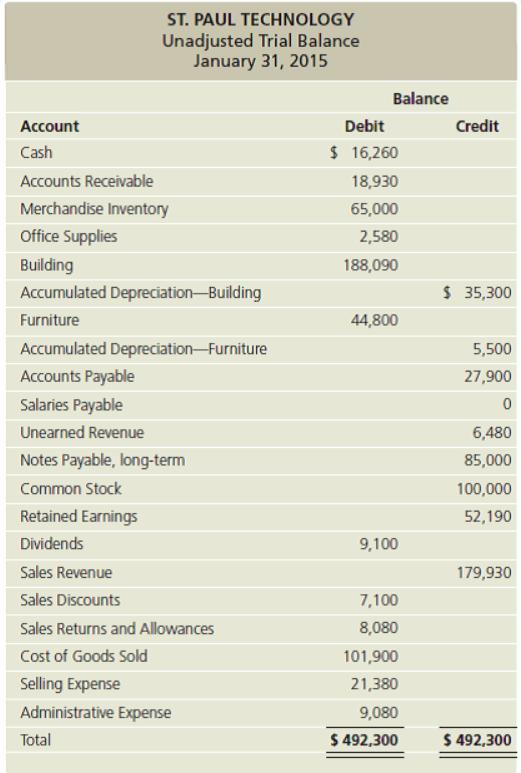

St. Paul Technology uses a perpetual inventory system. The end-of-month unadjusted trial balance of St. Paul Technology

Question:

St. Paul Technology uses a perpetual inventory system. The end-of-month unadjusted trial balance of St. Paul Technology at January 31, 2015, follows:

Additional data at January 31, 2015:

a. Office Supplies consumed during the month, $ 1,400. Half is selling expense, and the other half is administrative expense.

b. Depreciation for the month: building, $ 3,800; furniture, $ 4,600. One-fourth of depreciation is selling expense, and three-fourths is administrative expense.

c. Unearned revenue that has been earned during January, $ 4,420.

d. Accrued salaries, an administrative expense, $ 1,100.

e. Merchandise Inventory on hand, $ 63,460. St. Paul uses the perpetual inventory system.

Requirements

1. Using T-accounts open the accounts listed on the trial balance, inserting their unadjusted balances. Label the balances as Bal. Also open the Income Summary account.

2. Journalize and post the adjusting entries at January 31. Compute the ending balances in the T-accounts, and denote as Bal.

3. Enter the unadjusted trial balance on a worksheet, and complete the worksheet for the month ended January 31, 2015. St. Paul Technology groups all operating expenses under two accounts, Selling Expense and Administrative Expense. Leave two blank lines under Selling Expense and three blank lines under Administrative Expense.

4. Prepare the company’s multi-step income statement and statement of retained earnings for the month ended January 31, 2015. Also prepare the balance sheet at that date in report form.

5. Journalize and post the closing entries at January 31.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura