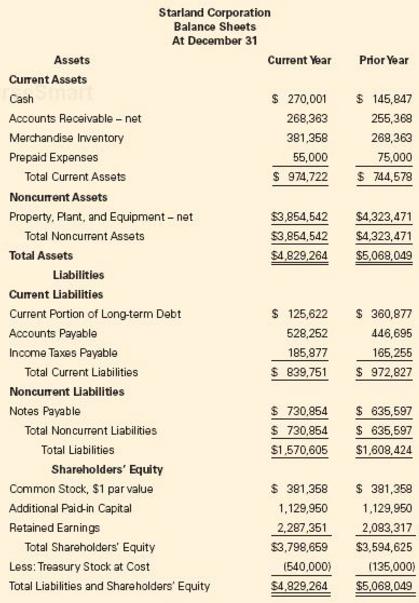

Star land Corporation provided the following comparative balance sheets and income statement. Star land Corporation Income Statement

Question:

Star land Corporation provided the following comparative balance sheets and income statement.

Star land Corporation

Income Statement

For the Year Ended December 31

Current Year

Sales……………………………………………. $ 1,875,050

Cost of Goods Sold……………………………... 1,125,030

Gross Profit……………………………………… $ 750,020

Selling, General, and Administrative Expenses…. $ 205,000

Bad Debt Expense……………………………….. 4,394

Depreciation Expense……………………………. 39,525

Total Operating Expenses………………………… $ 248,919

Income before Interest and Taxes………………… $ 501,101

Loss on Disposal of Equipment………………….. $ (50,000)

Interest Expense…………………………………... (12,500)

Income before Tax………………………………… $ 438,601

Income Tax Expense………………………………. (175,440)

Net Income………………………………………… $ 263,161

Additional Information:

1. Starland did not acquire any additional plant assets during the current year.

2. Starland sold equipment with a carrying value of $ 429,404 at a $ 50,000 loss.

3. The company borrowed additional funds by issuing a long-term note. Any debt payments made during the year reduced the current portion of long-term debt.

Required

Prepare the cash flow statement for Starland Corporation for the current year using the indirect method. Provide all required disclosures.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0132162302

1st edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella