Study Appendix 16A. General Mills, producer of Wheaties, Cheerios, Gold Medal Flour, and many other food products,

Question:

Study Appendix 16A. General Mills, producer of Wheaties, Cheerios, Gold Medal Flour, and many other food products, reported fiscal 2011 income before taxes of $2,428 million. Part of footnote 2 to the financial statements stated the following:

All inventories in the United States other than grain and certain organic products are valued at the lower of cost, using the last-in first-out (LIFO) method, or market.

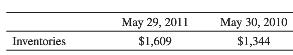

Inventories valued at the lower of LIFO cost or market are as follows (in millions):

If LIFO inventories were valued at the lower of FIFO cost or market, the inventories would have been $168 million and $142 million higher than those reported for fiscal 2011 and 2010, respectively.

Suppose the FIFO method had always been used for all inventories. Calculate General Mills’ operating income for fiscal 2011. By how much would the cumulative operating income for all years through 2011 differ from that reported? Would it be more or less than that reported?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta