Study Appendix 16A. Kalitzki Implements Company had sales revenue of $710,000 in 20X2. Pertinent data for its

Question:

Study Appendix 16A. Kalitzki Implements Company had sales revenue of $710,000 in 20X2.

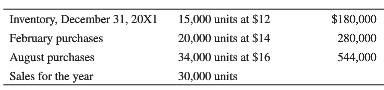

Pertinent data for its only product in 20X2 included the following:

1. Prepare a statement of gross margin for 20X2. Use two columns, one assuming LIFO and one assuming FIFO.

2. Assume that Kalitzki is reporting to the tax authorities and has a 45% income tax rate. Suppose all transactions are for cash. Which inventory method results in more cash for Kalitzki? By how much?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta

Question Posted: