From the transactions shown below, enter the appropriate journal abbreviation next to each transaction. Then, from the

Question:

From the transactions shown below, enter the appropriate journal abbreviation next to each transaction.

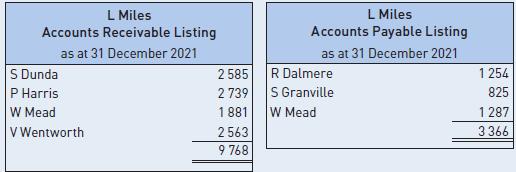

Then, from the information shown in figure 7.20 and the following transactions, prepare the relevant journals of L Miles for the dates in January 2022. Post the journals to the ledgers and prepare a trial balance and listings of the subsidiary ledgers. Periodic inventory applies.

On 31 December 2021, L Miles had the following account balances: GST payable $2442, premises $55 000, accounts receivable control $ . . . . . . . . . ., inventory $3488, bank overdraft $2190, office equipment $5900, accounts payable control $ . . . . . . . . . ., mortgage loan on premises $20 000, GST receivable $842 and capital $ . . . . . . . . . .

Transactions for January 2022 were as follows:

_______ 2 Received remittance from P Harris less $88 discount.

_______ 2 S Dunda paid account in full by cheque.

_______ 3 Received tax invoice from G Ilford $1177 ($1070 + $107 GST) for inventory.

_______ 4 Electronic transfer to S Granville for $803 in full settlement of account.

_______ 5 Direct deposit from V Wentworth $2563.

_______ 5 Received adjustment credit note from R Dalmere $66 ($60 + $6 GST) for short delivery.

_______ 7 Bank advised S Dunda’s cheque had been dishonoured and a $55 charge made for handling the dishonoured cheque to be charged to S Dunda.

_______ 8 Remittance paid to R Dalmere for the balance now owing ($1188).

_______ 8 Owner withdrew goods from inventory with a value of $165 ($150 + $15 GST).

_______ 9 Sent tax invoice to V Wentworth for $2838 ($2580 + $258 GST).

_______ 9 Purchased stock from L Combe for $1243 ($1130 + $113 GST) and paid by debit card.

_______10 Cash sale $1881 ($1710 + $171 GST).

_______12 Mailed adjustment credit note to V Wentworth $55 ($50 + $5 GST) for pricing adjustment.

_______13 Received $638 from S Dunda as part payment of account.

_______13 Cash sale of goods to Y Nora $2585 ($2350 + $235 GST).

_______15 Paid W Mead the December account of $1287.

_______16 Banked receipts from sales $1804 ($1640 + $164 GST).

_______18 Sold goods on credit to P Harris $3377 ($3070 + $307 GST).

_______18 Received funds electronically from W Mead for $1881.

_______18 Paid ATO the GST for December quarter.

_______19 Purchased goods on credit from R Dalmere $1419 ($1290 + $129 GST).

_______19 Drew cheque for art and music lessons for children $580.

_______20 Sold goods on credit to V Wentworth for $2651 ($2410 + $241 GST).

_______20 Goods purchased with debit card $1826 ($1660 + $166 GST) from R Mington.

_______21 Received tax invoice from S Granville for stock purchases $1782 ($1620 + $162 GST).

_______22 Sold goods to S Good for $1584 ($1440 + $144 GST), received funds electronically.

_______25 O Burn purchased inventory from L Miles $1507 ($1370 + $137 GST).

_______25 P Harris bought goods for $1969 ($1790 + $179 GST) on credit.

_______27 Bought office equipment from Camellia and Co $3960 ($3600 + $360 GST).

_______27 Tax invoiced W Mead for goods $3564 ($3240 + $324 GST).

_______30 Banked cheque $1716 ($1560 + $156 GST) for stock sold to S Amos.

_______30 Made a cash allowance to S Good for faulty stock $143 ($130 + $13 GST).

_______31 Received O Burn’s direct deposit less $33 discount.

_______31 Reallocated dishonour fee to bank charges for S Dunda and then wrote off the balance as bad debt and adjusted for GST.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson