A financial consultant has been asked by his client for advice on the relative performance of two

Question:

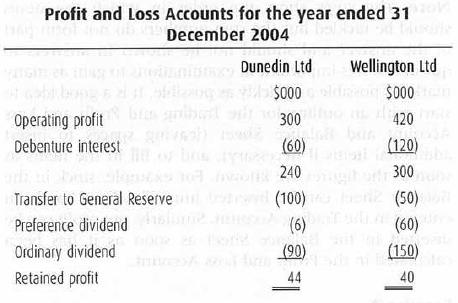

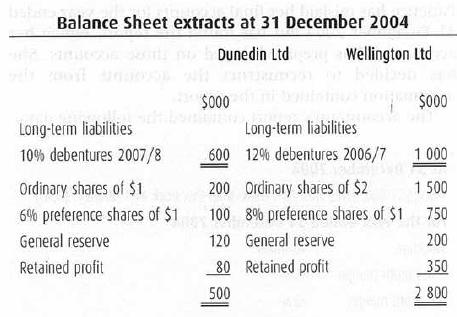

A financial consultant has been asked by his client for advice on the relative performance of two companies, Dunedin Ltd and Wellington Ltd. Extracts from the Profit and Loss Accounts for the year ended 31 December 2004 and the Balance Sheets at that date of the two companies are as follows.

The market values of the ordinary shares at 31 December 2004 were as follows.

Dunedin Ltd $2.70 Wellington Ltd $3.60

Required

(a) Calculate the following ratios to two decimal places for each company.

(i) Gearing

(ii) Interest cover

(iii) Earnings per share (EPS)

(iv) Dividend per share

(v) Dividend cover

(vi) Price earnings ratio (PER)

(vii) Dividend yield

(b) Compare and comment on the performance of the two companies in 2004 using the ratios calculated in (a).

Step by Step Answer: