Bell and Booker have been partners for some years, making up their accounts annually to 31 December.

Question:

Bell and Booker have been partners for some years, making up their accounts annually to 31 December. The partnership agreement contained the following provisions.

- Interest was allowed on capitals at 10% per annum.

- Booker was entitled to a salary of $15 000 per annum.

- Profits and losses were to be shared: Bell 2/3;Booker 1/3.

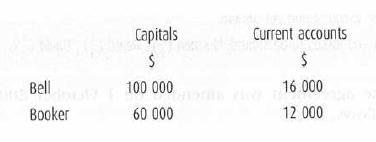

At 31 December 2003 the partners' Capital and Current account balances were as follows.

On 1 September 2004, Bell and Booker admitted their manager, Candell, as a partner. Candell had been receiving a salary of $24 000. The revised partnership agreement provided as follows.

- Partner's salary: Booker $18 000 per annum.

- Interest on capitals at 10% per annum.

- Profits and losses shared: Bell 2/5, Booker2/5, Candell 1/5.

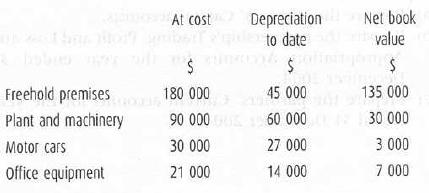

The partnership's fixed assets at cost at 31 December 2003 were as follows.

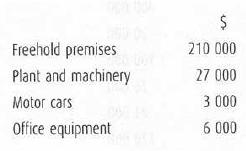

No additions to, or disposals of, fixed assets had taken place between 31 December 2003 and 31 August 2004. The assets were revalued at 1 September as follows.

Depreciation of fixed assets is calculated on cost and is provided as follows: freehold premises 4% per annum; plant and machinery 20% per annum; motor cars 25% per annum; office equipment 10% per annum.

Goodwill was valued at $60 000, but no Goodwill account was to be opened in the books.

On 1 September 2004, Candell paid $50 000 into the firm's bank account as capital, and also brought his private car, valued at $9000, into the business. On the same day, Bell transferred $20 000 from his Capital account to a loan account on which interest is to be paid at a rate of 12% per annum.

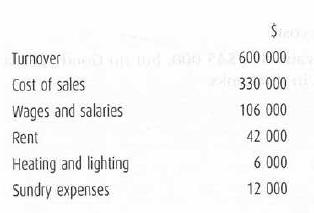

The following information is available from the partnership books for the year ended 31 December 2004.

Sales were spread evenly throughout the year and earned a uniform rate of gross profit.

Drawings in the year ended 31 December 2004 were: Bell $30 000: Booker $40 000; Candell $4000.

Required

(a) Prepare a Trading, Profit and Loss and Appropriation Account for the year ended 31 December 2004.

(b) Prepare the partners' Capital and Current accounts for the year ended 31 December 2004.

Step by Step Answer: