Mill has been a second-hand car dealer for some years. His Trading and Profit and Loss Account

Question:

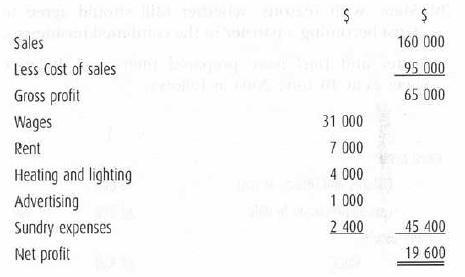

Mill has been a second-hand car dealer for some years. His Trading and Profit and Loss Account for the year ended 31 December 2003 was as follows.

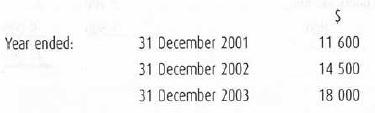

Mill's net profits for the previous two years were as follows.

Mill's friend, Grist, has also been trading for some years repairing and servicing motor vehicles. Grist's net profits for the past three years have been as follows.

The lease on Grist's premises is about to expire, and Grist has suggested to Mill that the two businesses should be combined and that he and Mill should become partners.

Mill estimates that combining the businesses will immediately improve his net profit by 10% and that the improvement will be maintained in future years. Grist estimates that his net profit will be increased by 20% and that this increase will also be maintained in the future.

The proposed partnership agreement would provide as follows.

Required

(a) Prepare a forecast Profit and Loss Appropriation Account of the partnership for the year ending 31 December 2004, assuming the partnership is formed on 1 January 2004.

(b) State, with reasons, whether Mill should agree to Grist becoming a partner in the combined businesses.

Step by Step Answer: