The information is given as for Nomen Ltd in exercise 3 in 36.4, with the addition of

Question:

The information is given as for Nomen Ltd in exercise 3 in 36.4, with the addition of the discounting factors for 20%: year 1 0.833; year 2 0.694; year 3 0.579; year 4 0.482; year 5 0.402.

Required

Calculate the internal rate of return for machines A and B.

- IRR can be calculated from two positive net present values but will be less accurate. The denominator of the fraction in the formula must be amended as follows: P + [(P - N) × p/p - n)]. If the discounting factors in a question produce only positive net present values, do not try to find another discounting rate; the examiner expects you to use the ones supplied in the question.

- When the receipts are constant for a number of consecutive years, the net present value of those receipts may be calculated quickly if the annual amount is multiplied by the sum of the factors for the years concerned. For example, if net receipts are $25000 in each of the first five years and the cost of capital is 10%, the NPV for the five years is $25 000 x (0.909 + 0.826 +0.751+ 0.683 +0.621) = $25 000 x 3.790 = $94 750

Data from Exercises 3

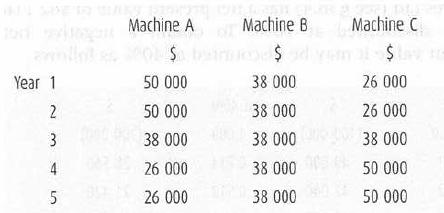

Nomen Ltd is considering buying a machine and has three options, machine A, B or C, only one of which it will buy. Each machine costs $135 000 and will have a five-year life with no residual value at the end of that time.

The net receipts for each machine over the five-year period are as follows.

Nomen Ltd's cost of capital is 12%.

The discounting factors at 12% are:

year 1. 0.893;

year 2. 0.797;

year 3. 0.712;

year 4. 0.636

year 5. 0.567.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: