Taking the same business as in Example8.2, on closer analysis we find that of the overheads that

Question:

Taking the same business as in Example 8.2, on closer analysis we find that of the overheads that total £20,000 next month, £8,000 relates to machines (depreciation, maintenance, rent of the space occupied by the machines and so on) and the remaining £12,000 to more general overheads. The other information about the business is exactly as it was before.

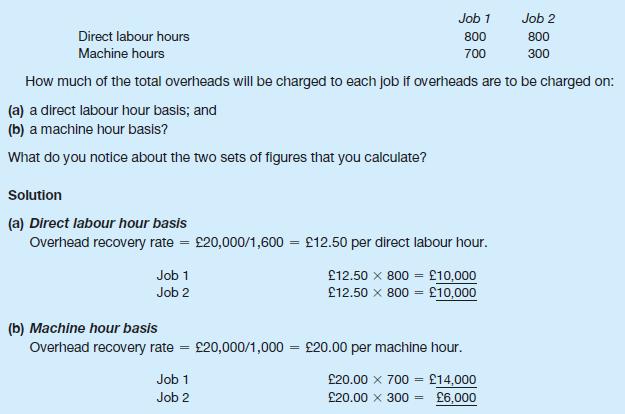

How much of the total overheads will be charged to each job if the machine-related overheads are to be charged on a machine hour basis and the remaining overheads are charged on a direct labour hour basis?

Data from Example 8.2

A business, that provides a service, expects to incur overheads totalling £20,000 next month. The total direct labour time worked is expected to be 1,600 hours and machines are expected to operate for a total of 1,000 hours.

During the next month, the business expects to do just two large jobs. Information concerning each job is as follows:

It is clear from these calculations that the total overheads charged to jobs is the same (that is, £20,000) whichever method is used. Whereas the machine hour basis gives Job 1 a higher share of these overheads than the direct labour hour method, the opposite is true for Job 2.

Step by Step Answer:

Accounting And Finance For Non Specialists

ISBN: 9781292334691

12th Edition

Authors: Peter Atrill, Eddie McLaney