The directors of Manuff (Steel) Ltd are considering closing one of the businesss factories. There has been

Question:

The directors of Manuff (Steel) Ltd are considering closing one of the business’s factories. There has been a reduction in the demand for the products made at the factory in recent years. The directors are not optimistic about the long-term prospects for these products. The factory is situated in an area where unemployment is high.

The factory is leased with four years of the lease remaining. The directors are uncertain whether the factory should be closed immediately or at the end of the period of the lease. Another business has offered to sublease the premises from Manuff (Steel) Ltd at a rental of £40,000 a year for the remainder of the lease period.

The machinery and equipment at the factory cost £1,500,000. The value at which they appear in the statement of financial position is £400,000. In the event of immediate closure, the machinery and equipment could be sold for £220,000. The working capital at the factory is £420,000. It could be liquidated for that amount immediately, if required. Alternatively, the working capital can be liquidated in full at the end of the lease period. Immediate closure would result in redundancy payments to employees of £180,000.

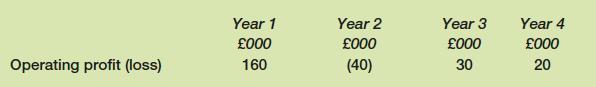

If the factory continues in operation until the end of the lease period, the following operating profits (losses) are expected:

These figures are derived after deducting a charge of £90,000 a year for depreciation of machinery and equipment. The residual value of the machinery and equipment at the end of the lease period is estimated at £40,000.

Redundancy payments are expected to be £150,000 at the end of the lease period if the factory continues in operation. The business has an annual cost of capital of 12 per cent. Ignore taxation.

Required:

(a) Determine the relevant cash flows arising from a decision to continue operations until the end of the lease period rather than to close immediately.

(b) Calculate the net present value of continuing operations until the end of the lease period, rather than closing immediately.

(c) What other factors might the directors take into account before making a final decision on the timing of the factory closure?

(d) State, with reasons, whether or not the business should continue to operate the factory until the end of the lease period.

Step by Step Answer:

Accounting And Finance For Non Specialists

ISBN: 9781292334691

12th Edition

Authors: Peter Atrill, Eddie McLaney