In Oregon, employers who are covered by the state workers compensation law withhold employee contributions from the

Question:

Cortez Company, a covered employer in Oregon, turns over the employer-employee workers€™ compensation con- tributions to its insurance carrier by the 15th of each month for the preceding month. During the month of July, the number of full-time employee-hours worked by the company€™s employees was 8,270; the number of part-time employee-hours was 1,950.

a. The amount the company should have withheld from its full- and part-time employees during the month of July for workers€™ compensation insurance is $................

b. The title you would give to the general ledger liability account to which the amount withheld from the employees€™ earnings would be credited is:...........................................

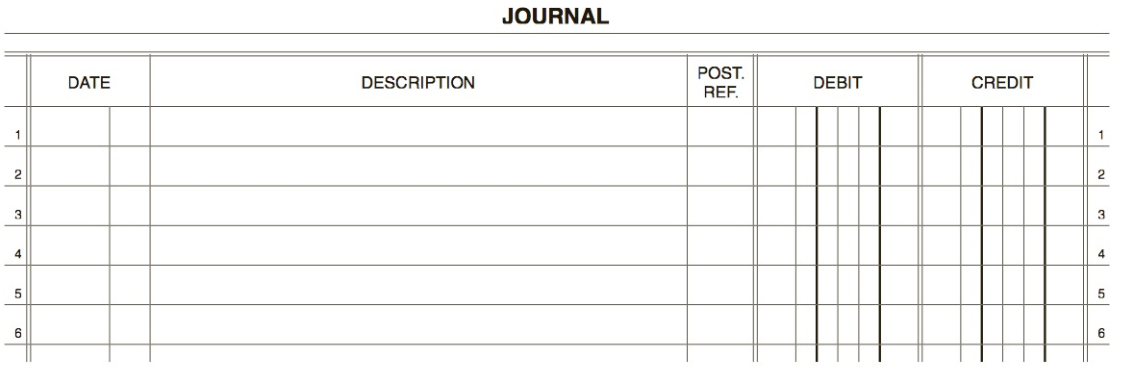

c. Journalize the entry on July 31 to record the employer€™s liability for workers€™ compensation insurance for the month.

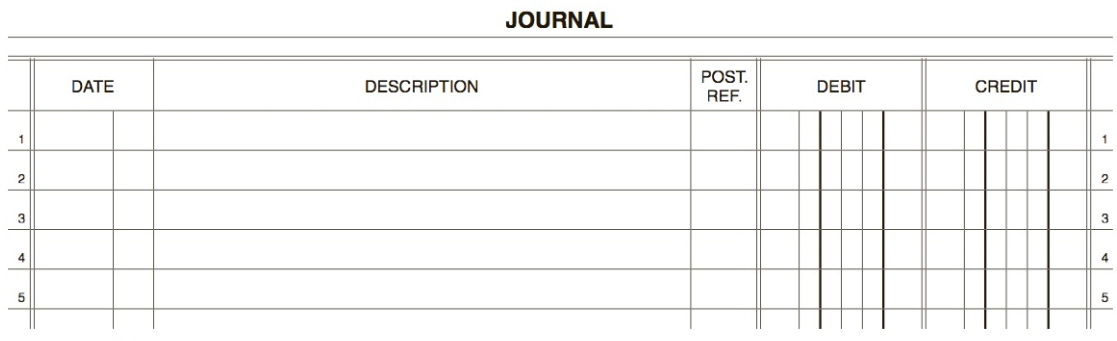

d. Journalize the entry on August 15 to record payment to the insurance carrier of the amount withheld from the employees€™ earnings for workers€™ compensation insurance and the amount of the employer€™s liability.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: