The directors of Mylo Ltd are currently considering two mutually exclusive investment projects. Both projects are concerned

Question:

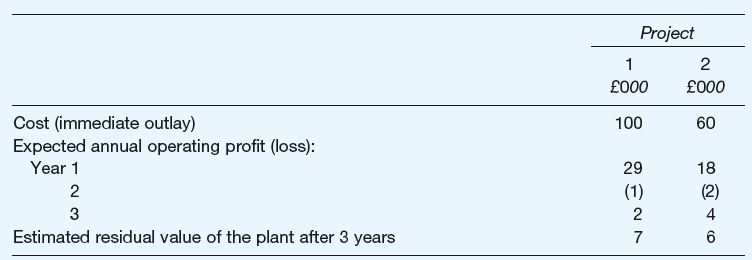

The directors of Mylo Ltd are currently considering two mutually exclusive investment projects. Both projects are concerned with the purchase of new plant. The following data are available for each project:

The business has an estimated cost of capital of 10 per cent. It uses the straight-line method of depreciation for all non-current (fixed) assets when calculating operating profit. Neither project would increase the working capital of the business. The business has sufficient funds to meet all investment expenditure requirements.

Required:(a) Calculate for each project:1 The net present value.2 The approximate internal rate of return.3 The payback period.

(b) S tate, with reasons, which, if any, of the two investment projects the directors of Mylo Ltd should accept.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Accounting and Finance An Introduction

ISBN: 978-1292088297

8th edition

Authors: Peter Atrill, Eddie McLaney