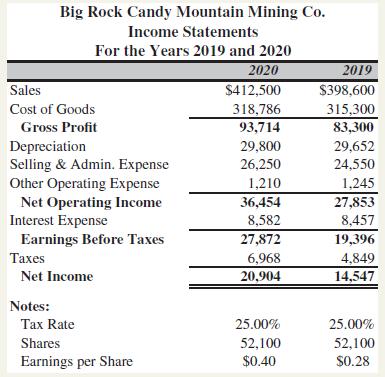

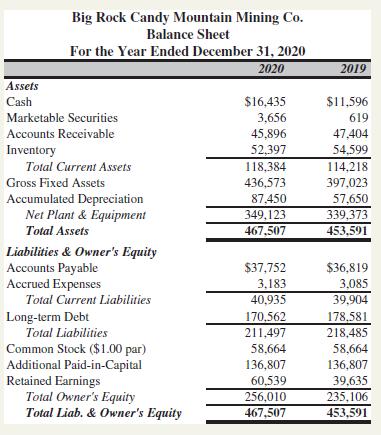

Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a

Question:

Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a new workbook.

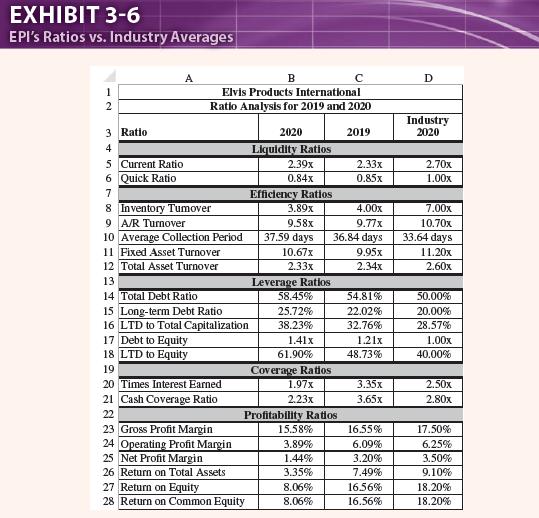

a. Set up a ratio worksheet similar to the one in Exhibit 3-6, page 99, and calculate all of the ratios for the firm.

b. Identify areas of concern, if any, using the ratios. Identify areas that have shown improvement, if any.

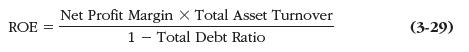

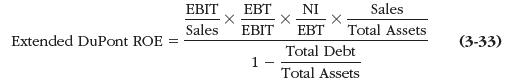

c. In 2020 the ROE increased. Explain, in words, why this increase occurred using the DuPont method from equation (3-29). Now use the extended DuPont method from equation (3-33).

d. Big Rock Candy Mountain Mining has shown an accounting profit in each of the past two years. Calculate the economic profit for these years and compare it to net income. The WACC is 9%.

e. Using Altman’s model for privately held firms, calculate the Z-score for Big Rock Candy Mountain Mining. Does it appear that the firm is in imminent danger of bankruptcy?

Equations

Exhibit 3-6.

Data from Exercises 1 chapter 2.

Using the data presented below:

Recreate the income statement and balance sheet using formulas wherever possible. Each statement should be on a separate worksheet. Try to duplicate the formatting exactly.

On another worksheet, create a statement of cash flows for 2020. Do not enter any numbers directly on this worksheet. All formulas should be linked directly to the source on previous worksheets.

Using Excel’s outlining feature, create an outline on the statement of cash flows that, when collapsed, shows only the subtotals for each section.

Suppose that sales were $425,000 in 2020 rather than $412,500. What is the 2020 net income and retained earnings?

Undo the changes from part d, and change the tax rate to 20%. What is the 2020 net income and retained earnings?

Step by Step Answer: