Alison runs an online gift shop, trading for cash with individual customers and offering trading on credit

Question:

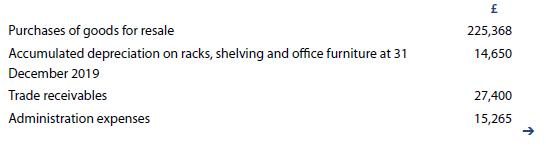

Alison runs an online gift shop, trading for cash with individual customers and offering trading on credit terms to businesses. She presents you with the following figures from her accounting records for the year ended 31 December 2019:

Alison provides you with the following additional information.

• Alison valued the inventory at 31 December 2019 at a cost of £22,600.

• All depreciation charges on non-current assets for the year to 31 December 2019 are included in the depreciation figures above.

• Rent on the trading unit prepaid at 31 December 2019 amounted to £3,000.

• Rates prepaid at 31 December 2019 amounted to £1,865.

• Accountancy costs of £1,250 had not been paid by the year end and are not included in the figures above.

• There were no other prepaid or accrued expenses at the year end.

• Alison would like to include an allowance for receivables of 10% of year-end trade receivables. There was no allowance for receivables at 31 December 2018.

Required

Using the list of balances and the additional information prepare Alison’s statement of profit or loss by nature for the year ended 31 December 2019 together with a statement of financial position at that date.

Step by Step Answer: