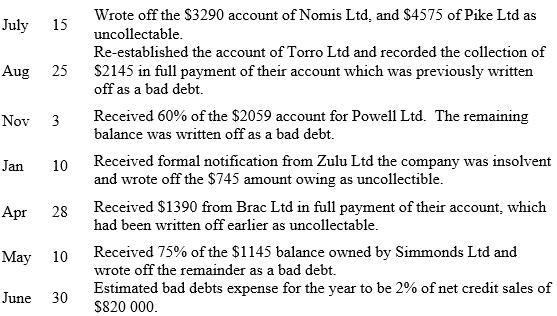

All transactions below relate to Alpha Ltds uncollectable accounts for the financial year ended 30 June 2023.

Question:

All transactions below relate to Alpha Ltd’s uncollectable accounts for the financial year ended 30 June 2023. Ignore GST

The Accounts Receivable account, prior to the transactions listed above, had a balance at 30 June 2023 of \($245\) 960. The opening balance of the Allowance for Doubtful Debts on 1 July 2022 amounted to \($12\) 300 credit.

Required:

(a) Prepare journal entries for each of the transactions listed above.

(b) Determine:

i. the balance in the Allowance for Doubtful Debts account after the 30 June adjustment ii. the expected realisable value of the accounts receivable as at 30 June.

(c) Assume that instead of basing the allowance for doubtful debts on net credit sales, the estimate of uncollectable accounts is based on an ageing of accounts receivable and that \($15\) 120 of the accounts receivable as at 30 June was estimated to be uncollectable. Determine:

i. the general journal entry to bring the allowance account to the desired balance ii. the expected realisable value of the accounts receivable as at 30 June.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie