At the end of the financial year ended 30 June 2025, the trial balance of Carol, Caitlin

Question:

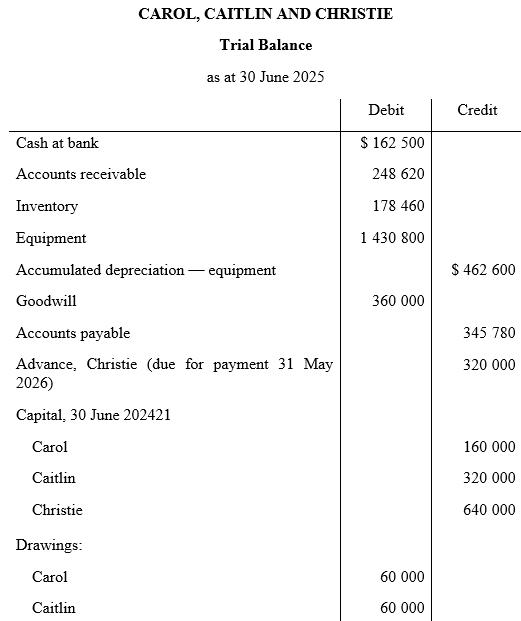

At the end of the financial year ended 30 June 2025, the trial balance of Carol, Caitlin and Christie is as shown below.

Christie made her advance before 1 July 2024. Carol and Caitlin each withdrew \($12000\) on 30 September 2024, \($8000\) on 31 December 2024, \($5000\) on 31 March 2025, and the remainder on 30 June 2025. Christie made her drawing on 30 June 2025.

The partnership agreement contains the following provisions in relation to the allocation of profits.

1. A salary of \($92000\) per year for Carol and \($56000\) per year for Caitlin.

2. Interest of 6% p.a. on capital contributed at the start of each financial year.

3. Interest on advances of 8% p.a.

4. Interest on drawings at 8% p.a.

Required

(a) Prepare the Profit Distribution account for the year ended 30 June 2025.

(b) Prepare the capital accounts for each partner at 30 June 2025.

(c) Prepare the balance sheet as at 30 June 2025.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie