Brighten BBQs Pty Ltd makes large barbecues and sells them through specialist barbecue stores and outdoor furniture

Question:

Brighten BBQs Pty Ltd makes large barbecues and sells them through specialist barbecue stores and outdoor furniture stores. Brighten BBQs Pty Ltd has been approached by a national department store, QMart, to produce 2000 barbecues per year for the next 3 years on their behalf.

Brighten BBQs Pty Ltd has the capacity to produce 20 000 barbecues per year but is currently making and selling only 15 000 under its own brand name at a wholesale price of \($300\) per barbecue. QMart wants the barbecues made for them to have QMart’s brand name on them and to have special features not on the standard model produced by Brighten BBQs Pty Ltd. QMart is prepared to pay only \($200\) per barbecue. If Brighten BBQs Pty Ltd takes the order it will need a special machine that will cost \($200\) 000 and last only the 3 years of the deal with QMart — it will then be scrapped for \($20\) 000. This machine will be depreciated using straight-line depreciation.

Currently the variable cost per barbecue is \($150\), and this will be the same variable cost for the QMart barbecues. Fixed costs for Brighten BBQs Pty Ltd are \($1\) 200 000 per year and this will not change if the special order is accepted, except for the depreciation costs of the new machine. Brighten BBQs Pty Ltd is taxed at the company rate of 30%.

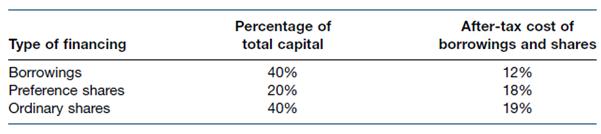

The capital structure of Brighten BBQs Pty Ltd is as follows.

Required

(a) Calculate the annual increase in cash flows if the special order for QMart is accepted. Assume all sales and variable expenses are eventually received and paid in cash.

(b) Calculate the weighted average cost of capital for Brighten BBQs.

(c) Calculate the net present value of the new machine that Brighten BBQs will have to purchase if the special order for QMart is accepted.

(d) Calculate the net present value index for the new machine.

(e) Calculate the payback period for the new machine.

(f) Calculate the return on average investment for the new machine.

(g) Comment on whether the Brighten BBQs should purchase the new machine based on your calculations above and suggest factors other than financial ones that should be taken into consideration when making the final decision about whether to accept the special order from QMart or not.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie