Gurjit Limited produces and sells ink jet printers. The selling price and cost card for each printer

Question:

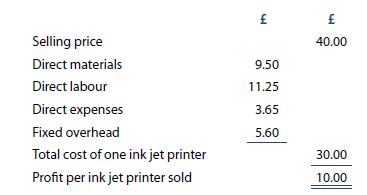

Gurjit Limited produces and sells ink jet printers. The selling price and cost card for each printer are as follows:

Currently, production and sales are running at 5,000 printers per annum. The fixed overhead allocated to each printer has been based on production and sales of 5,000 units. However, because of the popularity of the product and a strong advertising campaign, the directors of Gurjit Limited are expecting sales to rise to 10,000 units. The directors are currently reviewing the costs and profits made by printers along with their expectations of future profits from the increased sales. One option open to Gurjit Limited is to outsource production of their printers to another company. It is estimated that any outsourcing of production would lead to an increase in total fixed overheads of £40,000 to enable Gurjit Limited to ensure the quality of printers produced outside the company. The directors have a quote from Anand Limited to produce all 10,000 ink jet printers for £200,000. The directors of Gurjit Limited are considering whether to accept this offer and have asked for your advice.

In order to advise the directors of Gurjit Limited on whether to accept the offer from Anand Limited, you should:

(a) Calculate the current profit made at a level of sales and production of 5,000 ink jet printers per annum.

(b) Calculate the profit that will be made if sales and production rise to 10,000 printers per annum.

(c) Calculate the profit that will be made if sales and production rise to 10,000 printers and production of printers is outsourced to Anand Limited.

(d) Advise the directors of Gurjit Limited whether to outsource production to Anand Limited and what additional factors they should take into account in this decision other than costs and profit.

Step by Step Answer: