It is now August 2019. You have been asked by your head of department to prepare the

Question:

It is now August 2019. You have been asked by your head of department to prepare the monthly budgeted statement of profit or loss and the monthly cash budget for the 12 months ending 31 December 2020 together with a budgeted statement of financial position at that date. You have been provided with the following details to help you in this task:

(a) Positive cash balances at the end of each month will earn interest at the rate of 0.5% of the month end balance and this interest will be receivable in the following month.

(b) Negative cash balances at the end of each month will be charged interest at the rate of 2% of the month end balance and this interest will be payable in the following month.

(c) Cash of £30,000 will be spent in March 2020 on new plant and equipment. The new plant and equipment will be brought into use in the business in the month of purchase.

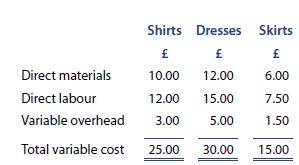

(d) Your company produces three products: shirts, dresses and skirts. The cost cards for each product are as follows:

(e) Selling prices are 140% of total variable cost. Payments for direct labour are made in accordance with note (i). 60% of the cost of materials is paid for one month after the month in which the materials were used in production, with the other 40% of materials being paid for two months after the month in which they were used in production. Where purchases of direct materials are greater than £20,000 in any one month, a 2.5% discount is given on all purchases of direct materials in that month. When purchases of direct materials are greater than £25,000 in any one month, a 3.5% discount is given on all purchases of direct materials in that month. Variable overhead is paid for in the following month.

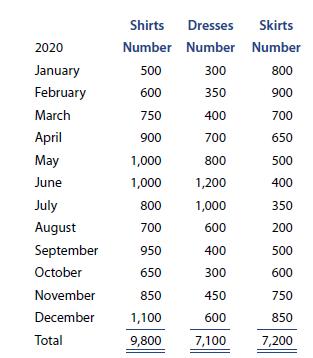

(f) The marketing department has estimated that sales of each product for the year will be as follows:

Your company sells its products directly to retailers. Retailers pay for the goods purchased as follows: 10% on delivery, 25% one month after delivery, 50% two months after delivery and the remaining 15% three months after delivery. All goods produced in the month are sold in the month and there are no inventories of finished goods or raw materials at the start or end of each month.

(g) The company rents its factory and offices and currently pays a total of £30,000 a year in rent. A rent review in March 2020 is expected to increase the annual factory rent to £36,000 from 1 August 2020. Quarterly rental payments in advance will be made on 1 February, 1 May, 1 August and 1 November 2020.

(h) Business rates for the six months to March 2020 will be paid on 1 October 2019 and the prepayment relating to January, February and March is shown in the forecast statement of financial position at 1 January 2020 below in note (k). Business rates of £7,500 per half year will be payable on 1 April 2020 and 1 October 2020. These business rates will cover the year from 1 April 2020 to 31 March 2021.

(i) Administrative and supervisory staff salaries are expected to total up to £9,000 a month. 68% of staff salaries and direct labour costs are payable in the month in which they are incurred with the remaining 32% representing deductions for tax and national insurance being paid to HM Revenue and Customs in the following month.

(j) An insurance premium of £6,000 is payable on 1 May 2020 covering all the insurance costs of the business for the year to 30 April 2021.

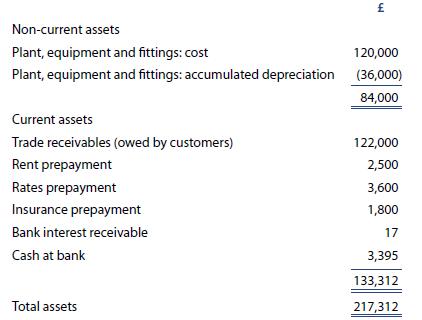

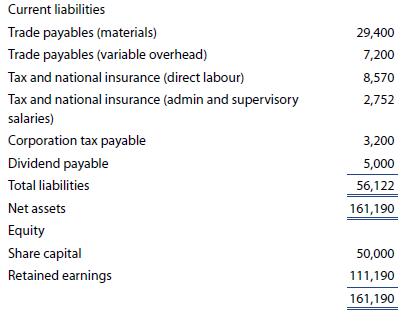

(k) The forecast statement of financial position at 1 January 2020 is as follows:

Notes to the forecast statement of financial position at 1 January 2020:

(i) Plant, equipment and fittings have a useful economic life of five years. Depreciation on these assets is charged monthly on the straight line basis.

(ii) Sales for October, November and December 2019 are budgeted to be £60,000, £70,000 and £75,000 respectively.

(iii) Purchases of materials totalled £20,000 in November 2019 and £21,400 (net of the 2% discount) in December 2019.

(iv) The dividend payable is scheduled for payment in April 2020 and the corporation tax is due for payment on 1 October 2020.

Required

Prepare the monthly budgeted statement of profit or loss and monthly cash budget for your company for the 12 months ended 31 December 2020 together with a budgeted statement of financial position at 31 December 2020.

Step by Step Answer: