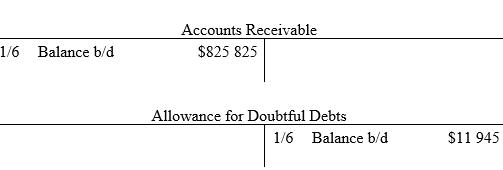

On 1 June, Cambria Financial Services Ltd had balances in the Accounts Receivable and Allowance for Doubtful

Question:

On 1 June, Cambria Financial Services Ltd had balances in the Accounts Receivable and Allowance for Doubtful Debts accounts as set out below. Ignore GST.

The following transactions occurred during the month of June:

1. Fees earned on credit, \($1\) 170 000.

2. Fees refunded, \($24\) 000.

3. Accounts receivable collected, \($1\) 413 750.

4. Accounts written off as uncollectable, \($14\) 370.

Based on an ageing of accounts receivable on 30 June, the firm decided that the Allowance for Doubtful Debts account should have a credit balance of \($12\) 675 on the Statement of Financial Position as at 30 June.

Required:

(a) Prepare general journal entries to record the four transactions above for the month of June and to adjust the Allowance for Doubtful Debts account to the required level.

(b) Show how accounts receivable and the allowance for doubtful debts would appear on the Statement of Financial Position at 30 June.

(c) On 1 August, Pete and Mandy Sanderson, whose account had been written off as uncollectable back in April, paid the full amount owing, a total of \($7\) 500. Prepare general journal entries to record the collection.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie