The case study can be completed without GST or with GST using either the rates for Australia

Question:

The case study can be completed without GST or with GST using either the rates for Australia or New Zealand. Inventory can be accounted for using either the periodic or the perpetual method. We have provided the option of completing the case with these methods.

Please refer to the instructions from your lecturer as to how this case should be completed. The information you need for the alternative treatments for recording merchandising transactions in the general journal using either (or both) the periodic or perpetual inventory system(s) are as follows:

- ignore GST record the transactions using the Australian rate of 10% GST record the transactions using the New Zealand rate of 15% GST.

Your chart of accounts and general ledger will need to be updated to include the following accounts: Inventory (120), GST Paid (150), GST Collected (250), Sales Revenue (410), Sales Returns & Allowances (420), Discount Received (430), Purchases (500) or Cost of Sales (505), Purchase Returns & Allowances (510), and Freight Costs (520).

i. If you have already used the suggested account numbers in your chart of accounts, use the closest available number.

ii. The use of some of the accounts suggested above will depend on the method selected for accounting for inventory – periodic versus perpetual.

iii. Use the accounts receivable and accounts payable accounts for all transactions that involve credit terms.

iv. To calculate the GST included in a transaction, divide by 11 for Australia and 7.667 for New Zealand, and then round to the nearest dollar. If no mention is made of GST, then that is because there is no GST in that transaction.

v. GST included in sales is posted to the GST Collected account and GST included in purchases is posted to the GST Paid account. Any discounts allowed or received will include GST. Please refer to the examples in the appendix to chapter 4 for guidance.

vi. Cost of sales figures for the perpetual inventory system only are quoted as $A for Australian students and $NZ for New Zealand students.

Required

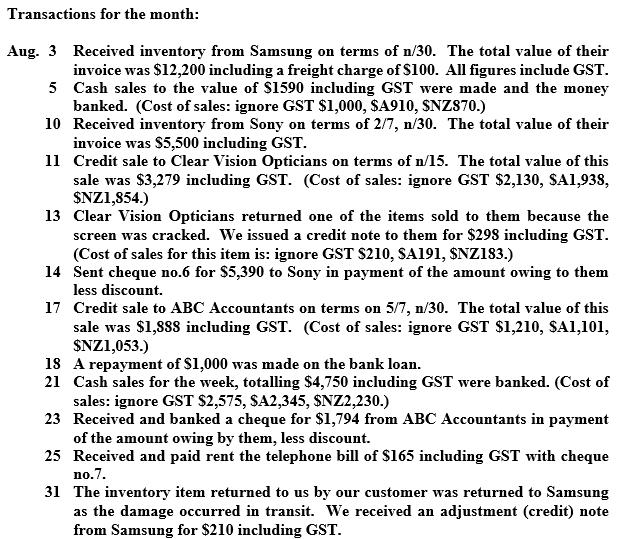

(a) Recording Use the general journal to record the transactions for August, with narrations.

(b) Recording Post the journal entries to the general ledger. This is a continuation from the previous chapters, so use existing and new general ledger accounts, remembering to include posting references. Use pencil to subtotal and calculate the balance of each account. Do not close off these accounts as they will be used again in the next chapter.

(c) Reporting Prepare a trial balance on 31 August.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie