The following actual statement of financial position was prepared for Martins Musical Supplies Ltd as at 30

Question:

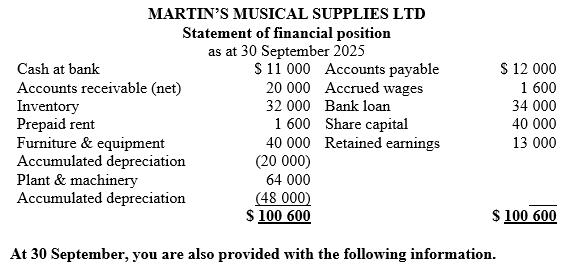

The following actual statement of financial position was prepared for Martin’s Musical Supplies Ltd as at 30 September 2025.

1. Sales forecasts available: October $39 000, November $44 000, December $48 000.

2. Cash sales account for 40% of sales. Credit sales are collected 30% in the month of sale, 50% in the following month and 20% in the second month following the sale.

3. Purchases are expected to be made at the rate of 60% of expected sales for each month and are purchased on credit.

4. Creditors are paid 40% in the month of purchase and 60% in the next month.

5. Inventory is projected to be $37 600 at 31 December 2025.

6. Rent on premises increased to $4950 per quarter from 1 August 2025. This is paid on the last day of the first month of each quarter.

7. Wages of $12 000 per month are normally paid as incurred, although December wages of $2000 are expected be outstanding at 31 December 2025 as a result of the normal payday being a week after the end of the year.

8. The following are paid as incurred: electricity $600 per month, interest on loan $220 per month, and cleaning contractor $400 per month. The loan principal is paid at the rate of $2000 per quarter.

9. Depreciation is charged at 10% per annum on the cost of the furniture and equipment and 15% per annum on the cost of the plant and machinery.

10. A new machine will be purchased for cash on 31 December 2025 for $16 000.

Required

(a) Prepare a budgeted statement of financial performance for the quarter ended 31 December 2025.

(b) Prepare a cash budget for the quarter ended 31 December 2025.

(c) Prepare a budgeted statement of financial position as at 31 December 2025.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie