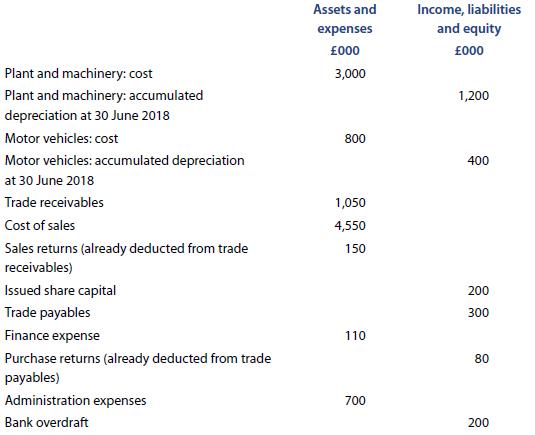

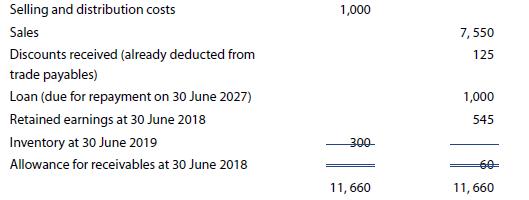

The following figures have been extracted from the accounting records of Textiles Limited, a cloth manufacturer and

Question:

The following figures have been extracted from the accounting records of Textiles Limited, a cloth manufacturer and wholesaler, at 30 June 2019:

Additional information

• Audit and accountancy fees (to be charged to administration expenses) of £10,000 have not been taken into account at 30 June 2019.

• Administration expenses include payments for insurance premiums of £30,000 for the 12 months to 31 December 2019.

• Since the year end, a customer of Textiles Limited has gone into liquidation owing £50,000. Textiles Limited does not expect to receive any cash from this trade receivable.

• The allowance for receivables is to be adjusted to 4% of trade receivables after deducting known irrecoverable debts. All irrecoverable debts and the movement in the allowance for receivables are to be charged to administration expenses.

• Depreciation for the year to 30 June 2019 still has to be calculated. Plant and machinery is to be depreciated at 20% straight line and motor vehicles are to be depreciated at 25% reducing balance. Plant and machinery depreciation should be charged to cost of sales and motor vehicle depreciation should be charged to distribution and selling expenses.

• Taxation on the profit for the year is to be calculated as 25% of the profit before tax.

Required

Prepare the statement of profit or loss for the year ended 30 June 2019 and the statement of financial position at that date in a form suitable for publication in accordance with International Financial Reporting Standards.

Step by Step Answer: